What is Global Blockchain in Utilities Market?

The Global Blockchain in Utilities Market refers to the application of blockchain technology within the utilities sector, which includes electricity, water, and gas services. Blockchain, a decentralized digital ledger, offers a secure and transparent way to record transactions and manage data. In the utilities market, blockchain can streamline operations, enhance security, and improve efficiency by enabling peer-to-peer energy trading, automating billing processes, and ensuring data integrity. This technology can also facilitate the integration of renewable energy sources by providing a reliable platform for tracking energy production and consumption. Additionally, blockchain can help utilities manage distributed energy resources and support the development of smart grids. By reducing the need for intermediaries and increasing transparency, blockchain technology can lead to cost savings and improved customer trust. As the utilities sector faces increasing pressure to modernize and become more sustainable, the adoption of blockchain technology presents a promising solution to address these challenges and drive innovation.

Vertical Solutions, Blockchain-as-a-Service, Others in the Global Blockchain in Utilities Market:

Vertical Solutions in the Global Blockchain in Utilities Market refer to tailored applications of blockchain technology that address specific needs within the utilities sector. These solutions can include energy trading platforms, grid management systems, and customer engagement tools. By leveraging blockchain, utilities can create more efficient and transparent systems for managing energy distribution and consumption. For instance, blockchain-based energy trading platforms enable peer-to-peer transactions, allowing consumers to buy and sell excess energy directly with each other. This not only promotes the use of renewable energy sources but also empowers consumers to take control of their energy usage. Grid management systems can benefit from blockchain by providing real-time data on energy flow and demand, helping utilities optimize their operations and reduce waste. Customer engagement tools can use blockchain to offer secure and transparent billing processes, enhancing customer trust and satisfaction. Blockchain-as-a-Service (BaaS) is another important aspect of the Global Blockchain in Utilities Market. BaaS provides utilities with the infrastructure and tools needed to develop and deploy blockchain applications without the need for extensive in-house expertise. This service model allows utilities to experiment with blockchain technology and implement solutions more quickly and cost-effectively. By outsourcing the technical aspects of blockchain development, utilities can focus on their core operations while still benefiting from the advantages of blockchain technology. Other applications of blockchain in the utilities market include supply chain management, regulatory compliance, and asset tracking. Blockchain can provide a secure and transparent way to track the movement of goods and materials throughout the supply chain, ensuring that all parties have access to accurate and up-to-date information. This can help utilities reduce costs, improve efficiency, and ensure compliance with regulatory requirements. Additionally, blockchain can be used to track the ownership and maintenance history of assets, such as power plants and transmission lines, providing utilities with valuable insights into their operations and helping them make more informed decisions. Overall, the Global Blockchain in Utilities Market offers a wide range of opportunities for utilities to improve their operations and better serve their customers. By adopting blockchain technology, utilities can enhance transparency, security, and efficiency, ultimately leading to a more sustainable and resilient energy system.

Proof of Concept, Pilot, Production, Others in the Global Blockchain in Utilities Market:

The usage of Global Blockchain in Utilities Market can be categorized into several stages, including Proof of Concept, Pilot, Production, and Others. In the Proof of Concept stage, utilities explore the potential applications of blockchain technology by developing small-scale projects to test its feasibility and effectiveness. This stage allows utilities to identify the most promising use cases for blockchain and assess the potential benefits and challenges associated with its implementation. By conducting proof of concept projects, utilities can gain valuable insights into how blockchain can be integrated into their existing systems and processes. The Pilot stage involves the implementation of blockchain technology on a larger scale, often involving real-world scenarios and multiple stakeholders. During this stage, utilities can test the scalability and performance of blockchain applications, as well as identify any potential issues that may arise during deployment. Pilots provide an opportunity for utilities to refine their blockchain solutions and gather feedback from users, helping them to make necessary adjustments before moving to full-scale production. In the Production stage, blockchain applications are fully integrated into the utilities' operations, providing tangible benefits such as increased efficiency, reduced costs, and improved customer satisfaction. At this stage, utilities can leverage blockchain technology to streamline processes, enhance data security, and enable new business models, such as peer-to-peer energy trading and decentralized energy management. The successful implementation of blockchain in production can lead to significant improvements in the overall performance and sustainability of the utilities sector. Other stages of blockchain usage in the utilities market may include ongoing research and development, collaboration with industry partners, and participation in industry consortia. These activities can help utilities stay informed about the latest advancements in blockchain technology and ensure that they remain competitive in a rapidly evolving market. By actively engaging in these activities, utilities can continue to explore new opportunities for blockchain adoption and drive innovation within the sector. Overall, the usage of blockchain in the utilities market offers numerous benefits and opportunities for growth. By adopting a phased approach to implementation, utilities can effectively manage the risks and challenges associated with blockchain technology while maximizing its potential to transform their operations and deliver value to their customers.

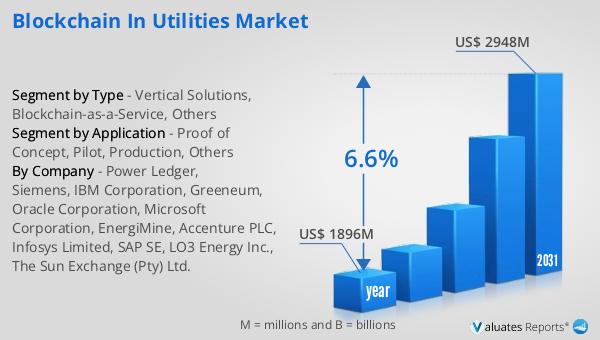

Global Blockchain in Utilities Market Outlook:

The global market for Blockchain in Utilities was valued at approximately $1.896 billion in 2024. It is anticipated to expand to a revised size of around $2.948 billion by 2031, reflecting a compound annual growth rate (CAGR) of 6.6% over the forecast period. This growth indicates a significant interest and investment in blockchain technology within the utilities sector, driven by the need for more efficient, secure, and transparent systems. As utilities face increasing pressure to modernize and adapt to changing energy landscapes, blockchain offers a promising solution to address these challenges. The projected growth of the market suggests that utilities are recognizing the potential benefits of blockchain technology, such as improved data management, enhanced security, and the ability to support new business models. By adopting blockchain, utilities can streamline their operations, reduce costs, and improve customer satisfaction, ultimately leading to a more sustainable and resilient energy system. As the market continues to evolve, it is likely that we will see further advancements in blockchain technology and its applications within the utilities sector, driving continued growth and innovation.

| Report Metric | Details |

| Report Name | Blockchain in Utilities Market |

| Accounted market size in year | US$ 1896 million |

| Forecasted market size in 2031 | US$ 2948 million |

| CAGR | 6.6% |

| Base Year | year |

| Forecasted years | 2025 - 2031 |

| Segment by Type |

|

| Segment by Application |

|

| By Region |

|

| By Company | Power Ledger, Siemens, IBM Corporation, Greeneum, Oracle Corporation, Microsoft Corporation, EnergiMine, Accenture PLC, Infosys Limited, SAP SE, LO3 Energy Inc., The Sun Exchange (Pty) Ltd. |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |