What is Global Aviation Reinsurance Market?

The Global Aviation Reinsurance Market is a specialized segment of the insurance industry that provides coverage to aviation insurers. Reinsurance is essentially insurance for insurance companies, allowing them to manage risk by sharing potential losses with other insurers. In the context of aviation, this is particularly crucial due to the high-risk nature of the industry, which involves significant financial exposure from aircraft accidents, liability claims, and catastrophic events. The market encompasses various types of reinsurance agreements tailored to meet the unique needs of aviation insurers, including coverage for airlines, airports, manufacturers, and service providers. The global aviation reinsurance market is influenced by factors such as the increasing number of air travelers, advancements in aircraft technology, and the growing complexity of aviation operations. These factors drive demand for comprehensive reinsurance solutions that can mitigate the financial impact of unforeseen events. Additionally, the market is shaped by regulatory requirements, economic conditions, and geopolitical factors that affect the aviation industry. As the aviation sector continues to expand, the need for robust reinsurance mechanisms becomes even more critical, ensuring that insurers can provide adequate coverage while maintaining financial stability.

Proportional Reinsurance, Non-proportional Reinsurance, Others in the Global Aviation Reinsurance Market:

Proportional reinsurance and non-proportional reinsurance are two primary types of reinsurance agreements used in the Global Aviation Reinsurance Market, each serving distinct purposes and offering different levels of risk-sharing. Proportional reinsurance, also known as pro-rata reinsurance, involves the reinsurer agreeing to share a proportion of the premiums and losses with the ceding company. This type of reinsurance is straightforward and involves two main forms: quota share and surplus share. In a quota share arrangement, the reinsurer receives a fixed percentage of all premiums and pays the same percentage of all claims. This approach provides the ceding company with immediate relief from risk exposure and capital strain, as the reinsurer assumes a consistent share of the risk. Surplus share reinsurance, on the other hand, allows the ceding company to retain a certain amount of risk, known as the retention limit, while the reinsurer covers losses exceeding this limit. This method is beneficial for insurers with varying levels of risk across their portfolio, as it allows them to retain more predictable risks while transferring higher risks to the reinsurer. Non-proportional reinsurance, also known as excess of loss reinsurance, operates differently by focusing on limiting the ceding company's exposure to large losses. In this arrangement, the reinsurer only pays for losses that exceed a specified threshold, known as the retention or attachment point. This type of reinsurance is particularly useful in the aviation industry, where catastrophic events can result in substantial financial losses. Non-proportional reinsurance provides a safety net for insurers by capping their maximum loss, thereby protecting their balance sheets from severe impacts. It is often used in conjunction with proportional reinsurance to create a balanced risk management strategy. Other forms of reinsurance in the aviation market include facultative reinsurance and treaty reinsurance. Facultative reinsurance is a case-by-case arrangement where the reinsurer evaluates and accepts specific risks, providing tailored coverage for unique or high-risk exposures. Treaty reinsurance, on the other hand, involves a pre-negotiated agreement covering a portfolio of risks, offering broader protection and simplifying the reinsurance process for the ceding company. These various reinsurance structures enable aviation insurers to effectively manage their risk exposure, optimize capital utilization, and maintain financial stability in a volatile industry.

Individuals, Groups, Others in the Global Aviation Reinsurance Market:

The Global Aviation Reinsurance Market plays a crucial role in providing financial protection and risk management solutions for individuals, groups, and other entities involved in the aviation sector. For individuals, aviation reinsurance offers peace of mind by ensuring that personal aviation insurance policies are backed by robust reinsurance agreements. This is particularly important for private pilots, aircraft owners, and small aviation businesses, as it guarantees that their insurers have the financial capacity to cover claims in the event of accidents or unforeseen incidents. By transferring a portion of the risk to reinsurers, individual policyholders can benefit from more comprehensive coverage and potentially lower premiums. For groups, such as airlines and aviation service providers, reinsurance is an essential component of their risk management strategy. Airlines face significant financial exposure due to the high value of aircraft, potential liability claims, and the impact of catastrophic events. Reinsurance allows these groups to mitigate their risk by sharing potential losses with reinsurers, ensuring that they can maintain operational continuity and financial stability even in the face of major incidents. This is particularly important for airlines operating in regions prone to natural disasters or geopolitical instability, where the risk of large-scale disruptions is higher. Other entities, such as airports, aircraft manufacturers, and maintenance providers, also benefit from the Global Aviation Reinsurance Market. Airports, for example, require coverage for potential liabilities arising from accidents on their premises, while manufacturers need protection against product liability claims. Reinsurance provides these entities with the financial backing necessary to manage their risk exposure and continue their operations without significant financial strain. Additionally, reinsurance supports innovation and growth within the aviation industry by enabling insurers to offer coverage for new and emerging risks, such as those associated with unmanned aerial vehicles (UAVs) and advanced air mobility solutions. By providing a safety net for insurers, reinsurance encourages the development and adoption of new technologies and business models, ultimately contributing to the overall advancement of the aviation sector.

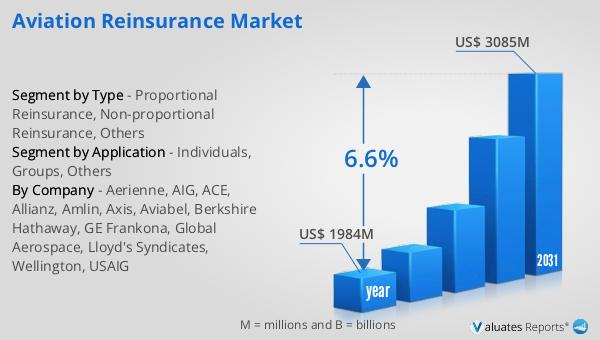

Global Aviation Reinsurance Market Outlook:

In 2024, the global market for Aviation Reinsurance was valued at approximately US$ 1984 million. This market is anticipated to grow significantly, reaching an estimated size of US$ 3085 million by the year 2031. This growth trajectory represents a compound annual growth rate (CAGR) of 6.6% over the forecast period. The expansion of the aviation reinsurance market is driven by several factors, including the increasing demand for air travel, advancements in aircraft technology, and the growing complexity of aviation operations. As the aviation industry continues to evolve, the need for comprehensive reinsurance solutions becomes more critical, ensuring that insurers can provide adequate coverage while maintaining financial stability. The projected growth of the aviation reinsurance market reflects the industry's resilience and adaptability in the face of changing market dynamics and emerging risks. This positive outlook underscores the importance of reinsurance as a vital component of the aviation industry's risk management strategy, providing financial protection and stability for insurers, policyholders, and other stakeholders.

| Report Metric | Details |

| Report Name | Aviation Reinsurance Market |

| Accounted market size in year | US$ 1984 million |

| Forecasted market size in 2031 | US$ 3085 million |

| CAGR | 6.6% |

| Base Year | year |

| Forecasted years | 2025 - 2031 |

| Segment by Type |

|

| Segment by Application |

|

| By Region |

|

| By Company | Aerienne, AIG, ACE, Allianz, Amlin, Axis, Aviabel, Berkshire Hathaway, GE Frankona, Global Aerospace, Lloyd's Syndicates, Wellington, USAIG |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |