What is Global Intellectual Property Financing Market?

The Global Intellectual Property Financing Market is a dynamic and evolving sector that plays a crucial role in the modern economy. Intellectual property (IP) refers to creations of the mind, such as inventions, literary and artistic works, designs, symbols, names, and images used in commerce. The financing market for IP involves leveraging these intangible assets to secure funding. This market allows businesses to use their IP as collateral to obtain loans or attract investors, thereby unlocking the value of their intellectual assets. As companies increasingly recognize the value of their IP, the demand for IP financing solutions has grown. This market is particularly important for innovation-driven industries where IP assets can be more valuable than physical assets. By providing a mechanism to monetize IP, the Global Intellectual Property Financing Market supports business growth, innovation, and competitiveness on a global scale. It enables companies to invest in research and development, expand operations, and enter new markets, thereby fostering economic development and technological advancement. The market is characterized by a range of financial instruments and services, including IP-backed loans, IP securitization, and IP valuation services, which are tailored to meet the diverse needs of businesses across different sectors.

Trade Marks, Design Rights, Patents, Copyright in the Global Intellectual Property Financing Market:

Trade Marks, Design Rights, Patents, and Copyright are fundamental components of the Global Intellectual Property Financing Market, each serving distinct purposes and offering unique benefits. Trademarks are symbols, names, or phrases legally registered or established by use as representing a company or product. They are crucial for brand identity and consumer recognition, making them valuable assets in the IP financing market. Companies can leverage trademarks to secure funding by demonstrating brand strength and market presence. Design Rights protect the visual design of objects that are not purely utilitarian. They cover the appearance, style, and aesthetics of a product, which can be critical in industries like fashion, automotive, and consumer electronics. By protecting design rights, companies can enhance their competitive edge and attract investors interested in innovative and appealing products. Patents are exclusive rights granted for an invention, providing the patent holder with the right to decide how or whether the invention can be used by others. Patents are vital in the IP financing market as they protect technological innovations and can be used as collateral to secure funding for further research and development. They are particularly important in sectors such as pharmaceuticals, biotechnology, and engineering, where innovation is key to success. Copyright protects the use of creative works, such as books, music, films, and software. In the IP financing market, copyrights can be monetized through licensing agreements, allowing creators to generate revenue from their works. This is especially relevant in the entertainment and media industries, where content is a primary asset. The Global Intellectual Property Financing Market provides a platform for businesses to leverage these IP rights to access capital, drive innovation, and enhance their market position. By understanding and utilizing these IP rights, companies can unlock the full potential of their intellectual assets, ensuring long-term growth and sustainability.

SMEs, Large Enterprises in the Global Intellectual Property Financing Market:

The usage of the Global Intellectual Property Financing Market varies significantly between Small and Medium-sized Enterprises (SMEs) and Large Enterprises, reflecting their different needs, resources, and strategic goals. For SMEs, the IP financing market offers a vital lifeline to access capital that might otherwise be unavailable through traditional financing channels. SMEs often face challenges in securing funding due to limited physical assets and credit history. However, by leveraging their IP assets, such as patents, trademarks, and copyrights, SMEs can obtain the necessary funding to support their growth and innovation initiatives. This is particularly important for startups and technology-driven companies, where IP assets can be more valuable than tangible assets. The ability to monetize IP allows SMEs to invest in research and development, expand their product offerings, and enter new markets, thereby enhancing their competitiveness and market presence. On the other hand, Large Enterprises typically have more established financial resources and access to a broader range of financing options. However, the IP financing market still plays a crucial role in their strategic planning and financial management. Large Enterprises often have extensive IP portfolios that can be leveraged to optimize their capital structure, reduce financing costs, and enhance shareholder value. By using IP as collateral, these companies can secure favorable loan terms, access additional funding for mergers and acquisitions, and invest in strategic initiatives that drive long-term growth. Furthermore, the IP financing market enables Large Enterprises to manage their IP assets more effectively, ensuring they are fully utilized and aligned with the company's overall business strategy. In both cases, the Global Intellectual Property Financing Market provides a valuable mechanism for businesses to unlock the value of their IP assets, supporting innovation, growth, and competitiveness in an increasingly knowledge-driven economy.

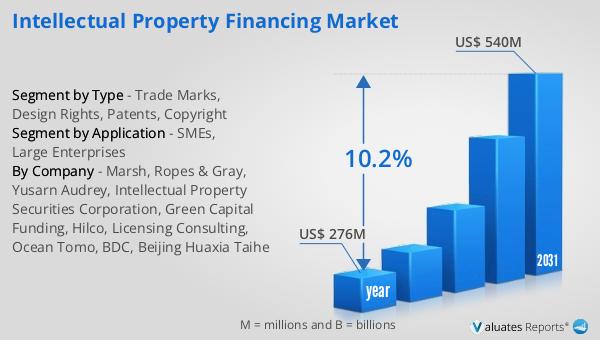

Global Intellectual Property Financing Market Outlook:

In 2024, the global market for Intellectual Property Financing was valued at approximately $276 million. This market is projected to expand significantly, reaching an estimated size of $540 million by 2031. This growth represents a compound annual growth rate (CAGR) of 10.2% over the forecast period. Such robust growth underscores the increasing recognition of intellectual property as a valuable asset class that can be leveraged for financial gain. The expansion of this market is driven by several factors, including the growing importance of innovation and technology in the global economy, the increasing complexity of IP portfolios, and the need for businesses to access alternative financing sources. As companies continue to invest in research and development, the demand for IP financing solutions is expected to rise, providing businesses with the capital needed to bring new products and services to market. Additionally, the globalization of markets and the rise of digital technologies have heightened the importance of protecting and monetizing IP assets, further fueling the growth of the IP financing market. This market outlook highlights the critical role that IP financing plays in supporting business growth and innovation, enabling companies to unlock the full potential of their intellectual assets and drive economic development on a global scale.

| Report Metric | Details |

| Report Name | Intellectual Property Financing Market |

| Accounted market size in year | US$ 276 million |

| Forecasted market size in 2031 | US$ 540 million |

| CAGR | 10.2% |

| Base Year | year |

| Forecasted years | 2025 - 2031 |

| Segment by Type |

|

| Segment by Application |

|

| By Region |

|

| By Company | Marsh, Ropes & Gray, Yusarn Audrey, Intellectual Property Securities Corporation, Green Capital Funding, Hilco, Licensing Consulting, Ocean Tomo, BDC, Beijing Huaxia Taihe |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |