What is Global Reverse Mortgage Providers Market?

The Global Reverse Mortgage Providers Market is a unique financial platform that allows homeowners, particularly those who are elderly, to convert a portion of their home equity into cash. This is done without having to sell their homes or take on additional monthly bills. The market is a global one, with providers offering these services in various parts of the world. The concept of reverse mortgages is relatively simple, but the market itself is complex, with various factors influencing its growth and development. These factors include the aging population, economic conditions, and changes in government policies and regulations. The market is also influenced by the different types of reverse mortgages available, including Home Equity Conversion Mortgages (HECMs), Single-purpose Reverse Mortgages, and Proprietary Reverse Mortgages.

Home Equity Conversion Mortgages (HECMs), Single-purpose Reverse Mortgages, Proprietary Reverse Mortgages in the Global Reverse Mortgage Providers Market:

Home Equity Conversion Mortgages (HECMs), Single-purpose Reverse Mortgages, and Proprietary Reverse Mortgages are the three main types of reverse mortgages available in the Global Reverse Mortgage Providers Market. HECMs are federally insured reverse mortgages that are backed by the U.S. Department of Housing and Urban Development. These are the most common type of reverse mortgages and offer a variety of payment options. Single-purpose Reverse Mortgages are offered by some state and local government agencies and non-profit organizations. These are the least expensive option, but they can only be used for one purpose, which is specified by the lender. Proprietary Reverse Mortgages are private loans that are backed by the companies that develop them. These can be more expensive than the other types, but they offer higher loan advances for higher-valued homes.

Debt, Health Care Related, Renovations, Income Supplement, Living Expenses in the Global Reverse Mortgage Providers Market:

The Global Reverse Mortgage Providers Market is used in various areas, including Debt, Health Care Related, Renovations, Income Supplement, and Living Expenses. In the area of Debt, reverse mortgages can be used to pay off existing mortgages, thereby eliminating monthly mortgage payments. In Health Care Related, they can be used to cover medical expenses, long-term care costs, and other health-related expenses. In Renovations, they can be used to make home improvements or modifications to accommodate aging in place. In Income Supplement, they can be used to supplement retirement income, thereby improving the quality of life for retirees. In Living Expenses, they can be used to cover daily living expenses, thereby providing financial security for homeowners.

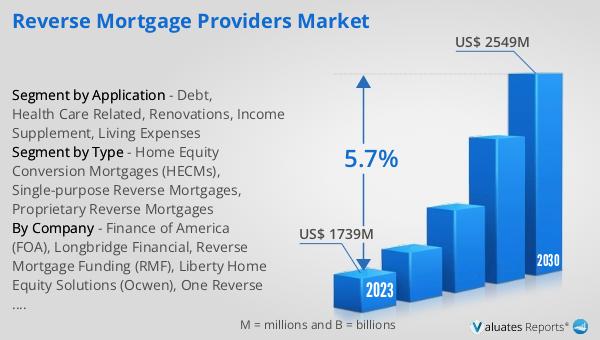

Global Reverse Mortgage Providers Market Outlook:

The Global Reverse Mortgage Providers Market has shown significant growth over the years. In 2023, the market was valued at US$ 1637.6 million and is expected to reach US$ 2425 million by 2030, growing at a Compound Annual Growth Rate (CAGR) of 5.7% during the forecast period of 2024 to 2030. The largest use of reverse mortgages is in the area of Debt, which accounted for about 36% of the global market in 2019. Health Care Related is another major area, accounting for approximately 24% of the market. Geographically, North America is the largest region for the Reverse Mortgage Providers market, holding a share of 54%. Europe follows with a 28% share, while the Asia-Pacific region holds over 10%.

| Report Metric | Details |

| Report Name | Reverse Mortgage Providers Market |

| Accounted market size in 2023 | US$ 1637.6 million |

| Forecasted market size in 2030 | US$ 2425 million |

| CAGR | 5.7% |

| Base Year | 2023 |

| Forecasted years | 2024 - 2030 |

| Segment by Type |

|

| Segment by Application |

|

| By Region |

|

| By Company | American Advisors Group (AAG), Finance of America Reverse (FAR), Reverse Mortgage Funding (RMF), Liberty Home Equity Solutions (Ocwen), One Reverse Mortgage (Quicken Loans), Mutual of Omaha Mortgage, HighTechLending, Fairway Independent Mortgage Corporation, Open Mortgage, Longbridge Financial |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |