What is Global Vascular Reconstruction Device Market?

The Global Vascular Reconstruction Device Market is a specialized segment within the broader medical device industry, focusing on devices used to repair, reconstruct, or replace blood vessels. These devices are crucial in treating various vascular conditions, such as aneurysms, blockages, and other vascular diseases that can lead to serious health complications if left untreated. The market encompasses a wide range of products, including stents, grafts, and patches, each designed to address specific vascular issues. The demand for vascular reconstruction devices is driven by the increasing prevalence of cardiovascular diseases, advancements in medical technology, and the growing aging population, which is more susceptible to vascular conditions. Additionally, the market is influenced by healthcare policies, reimbursement scenarios, and the availability of skilled healthcare professionals. As healthcare systems worldwide strive to improve patient outcomes and reduce healthcare costs, the adoption of advanced vascular reconstruction devices is expected to rise. This market is characterized by continuous innovation, with companies investing in research and development to create more effective and minimally invasive solutions. Overall, the Global Vascular Reconstruction Device Market plays a vital role in enhancing patient care and improving the quality of life for individuals with vascular diseases.

2.5-4.0 mm, 4.5-6.5 mm in the Global Vascular Reconstruction Device Market:

In the Global Vascular Reconstruction Device Market, devices are categorized based on their size, with two prominent categories being 2.5-4.0 mm and 4.5-6.5 mm. These size specifications are crucial as they determine the suitability of the device for different types of vascular procedures and patient anatomies. The 2.5-4.0 mm devices are typically used in smaller blood vessels, such as those found in the coronary arteries. These devices are essential in procedures like angioplasty, where they help to open up narrowed or blocked blood vessels, restoring normal blood flow. The smaller size allows for precision in navigating through the intricate network of smaller vessels, reducing the risk of damage to the vessel walls. On the other hand, the 4.5-6.5 mm devices are used in larger vessels, such as those in the peripheral vascular system. These devices are crucial in treating conditions like peripheral artery disease, where larger vessels are affected by blockages or narrowing. The larger size of these devices provides the necessary support and stability to maintain vessel patency and ensure adequate blood flow. Both size categories are integral to the market, as they cater to different patient needs and clinical scenarios. The choice of device size is determined by various factors, including the location and severity of the vascular condition, the patient's anatomy, and the specific goals of the procedure. In addition to size, other factors such as material composition, flexibility, and compatibility with other medical devices also play a role in the selection process. The development of these devices involves extensive research and testing to ensure they meet the highest standards of safety and efficacy. Manufacturers are continually working to improve the design and functionality of these devices, incorporating advanced materials and technologies to enhance their performance. For instance, the use of drug-eluting coatings on stents has been a significant advancement, helping to reduce the risk of restenosis, or re-narrowing of the vessel, after the procedure. Furthermore, the integration of imaging technologies with vascular reconstruction devices has improved the precision and accuracy of procedures, allowing for better visualization and navigation within the vascular system. The market for these devices is highly competitive, with numerous companies vying for market share by offering innovative solutions and expanding their product portfolios. Regulatory approvals and clinical trials are critical components of the market, as they ensure that new devices meet the necessary safety and efficacy standards before they can be used in clinical practice. The regulatory landscape varies across regions, with different countries having their own set of guidelines and requirements for medical device approval. This can pose challenges for manufacturers, who must navigate complex regulatory processes to bring their products to market. Despite these challenges, the Global Vascular Reconstruction Device Market continues to grow, driven by the increasing demand for minimally invasive procedures and the rising prevalence of vascular diseases. As the market evolves, there is a growing emphasis on personalized medicine, with devices being tailored to meet the specific needs of individual patients. This trend is expected to drive further innovation and development in the market, as companies strive to create more effective and patient-centric solutions. Overall, the 2.5-4.0 mm and 4.5-6.5 mm devices are critical components of the Global Vascular Reconstruction Device Market, playing a vital role in improving patient outcomes and advancing the field of vascular medicine.

Aneurysm, Other in the Global Vascular Reconstruction Device Market:

The Global Vascular Reconstruction Device Market finds significant application in the treatment of aneurysms and other vascular conditions. Aneurysms are abnormal bulges or ballooning in the wall of a blood vessel, which can lead to life-threatening complications if they rupture. Vascular reconstruction devices, such as stent grafts and endovascular coils, are used to reinforce the weakened vessel wall and prevent rupture. These devices are designed to fit precisely within the affected vessel, providing structural support and reducing the risk of further damage. The use of minimally invasive techniques, such as endovascular aneurysm repair (EVAR), has revolutionized the treatment of aneurysms, offering patients a safer and less invasive alternative to traditional open surgery. In addition to aneurysms, vascular reconstruction devices are used to address a wide range of other vascular conditions, including stenosis, occlusions, and vascular malformations. These conditions can lead to reduced blood flow and oxygen delivery to vital organs, resulting in serious health complications. Vascular reconstruction devices, such as angioplasty balloons and vascular grafts, are used to restore normal blood flow and improve patient outcomes. The choice of device and treatment approach depends on various factors, including the location and severity of the condition, the patient's overall health, and the specific goals of the procedure. The development of these devices involves extensive research and testing to ensure they meet the highest standards of safety and efficacy. Manufacturers are continually working to improve the design and functionality of these devices, incorporating advanced materials and technologies to enhance their performance. For instance, the use of bioresorbable materials in stents and grafts has been a significant advancement, allowing the device to gradually dissolve and be absorbed by the body after it has served its purpose. This reduces the risk of long-term complications and eliminates the need for additional procedures to remove the device. Furthermore, the integration of imaging technologies with vascular reconstruction devices has improved the precision and accuracy of procedures, allowing for better visualization and navigation within the vascular system. The market for these devices is highly competitive, with numerous companies vying for market share by offering innovative solutions and expanding their product portfolios. Regulatory approvals and clinical trials are critical components of the market, as they ensure that new devices meet the necessary safety and efficacy standards before they can be used in clinical practice. The regulatory landscape varies across regions, with different countries having their own set of guidelines and requirements for medical device approval. This can pose challenges for manufacturers, who must navigate complex regulatory processes to bring their products to market. Despite these challenges, the Global Vascular Reconstruction Device Market continues to grow, driven by the increasing demand for minimally invasive procedures and the rising prevalence of vascular diseases. As the market evolves, there is a growing emphasis on personalized medicine, with devices being tailored to meet the specific needs of individual patients. This trend is expected to drive further innovation and development in the market, as companies strive to create more effective and patient-centric solutions. Overall, the use of vascular reconstruction devices in the treatment of aneurysms and other vascular conditions plays a vital role in improving patient outcomes and advancing the field of vascular medicine.

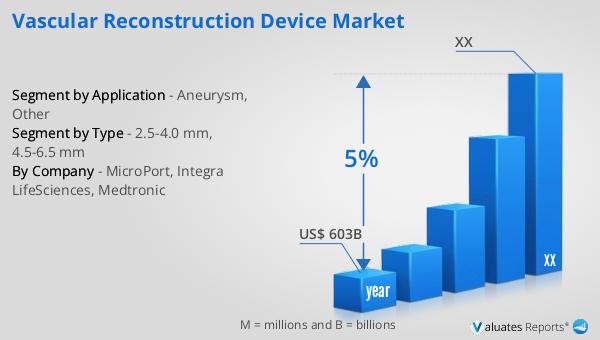

Global Vascular Reconstruction Device Market Outlook:

Our research indicates that the global market for medical devices is projected to reach approximately $603 billion in 2023, with an anticipated growth rate of 5% annually over the next six years. This growth trajectory underscores the expanding demand for medical devices across various healthcare sectors, driven by technological advancements, an aging global population, and the increasing prevalence of chronic diseases. The medical device industry encompasses a wide range of products, from simple bandages to complex surgical instruments and high-tech diagnostic equipment. As healthcare systems worldwide strive to improve patient outcomes and reduce costs, the adoption of innovative medical devices is expected to rise. This growth is further supported by the increasing focus on personalized medicine, which tailors medical treatment to the individual characteristics of each patient. Additionally, the integration of digital technologies, such as artificial intelligence and the Internet of Things, into medical devices is transforming the industry, enabling more precise diagnostics, real-time monitoring, and improved patient care. The regulatory landscape for medical devices is also evolving, with stricter guidelines and standards being implemented to ensure the safety and efficacy of new products. This presents both challenges and opportunities for manufacturers, who must navigate complex regulatory processes to bring their products to market. Despite these challenges, the global medical device market remains a dynamic and rapidly growing sector, offering significant opportunities for innovation and investment. As the market continues to evolve, companies that can successfully adapt to changing trends and meet the diverse needs of healthcare providers and patients will be well-positioned to thrive in this competitive landscape.

| Report Metric | Details |

| Report Name | Vascular Reconstruction Device Market |

| Accounted market size in year | US$ 603 billion |

| CAGR | 5% |

| Base Year | year |

| Segment by Type |

|

| Segment by Application |

|

| Consumption by Region |

|

| By Company | MicroPort, Integra LifeSciences, Medtronic |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |