What is Global Application Performance Monitoring Software Market?

The Global Application Performance Monitoring (APM) Software Market is a rapidly evolving sector that focuses on ensuring the optimal performance of software applications. This market is crucial for businesses that rely heavily on software applications to deliver services and products efficiently. APM software helps organizations monitor and manage the performance of their applications by providing insights into application behavior, user experience, and system resources. It identifies performance bottlenecks, detects anomalies, and ensures that applications run smoothly, thereby enhancing user satisfaction and business productivity. The market encompasses a wide range of solutions, from basic monitoring tools to advanced analytics platforms that leverage artificial intelligence and machine learning. As businesses continue to digitize and move towards cloud-based solutions, the demand for robust APM software is expected to grow. This growth is driven by the need for businesses to maintain high application performance standards in an increasingly competitive and fast-paced digital environment. The APM market is characterized by a diverse range of vendors offering various solutions tailored to different business needs, from small startups to large enterprises.

On-Premises, Cloud Based in the Global Application Performance Monitoring Software Market:

In the Global Application Performance Monitoring Software Market, deployment models play a significant role in how businesses choose to implement APM solutions. Two primary deployment models are On-Premises and Cloud-Based. On-Premises APM solutions are installed and run on the company's own servers and infrastructure. This model offers businesses greater control over their data and systems, which is particularly important for organizations with stringent security and compliance requirements. On-Premises solutions are often preferred by large enterprises that have the resources to manage and maintain their own IT infrastructure. These solutions provide a high level of customization and integration with existing systems, allowing businesses to tailor the APM software to their specific needs. However, On-Premises solutions can be costly to implement and maintain, as they require significant investment in hardware, software, and IT personnel. On the other hand, Cloud-Based APM solutions are hosted on the vendor's servers and accessed via the internet. This model offers several advantages, including lower upfront costs, scalability, and ease of deployment. Cloud-Based solutions are particularly attractive to small and medium-sized enterprises (SMEs) that may not have the resources to invest in extensive IT infrastructure. These solutions allow businesses to quickly deploy APM software without the need for significant capital expenditure. Additionally, Cloud-Based APM solutions are often updated automatically by the vendor, ensuring that businesses always have access to the latest features and security updates. The flexibility and scalability of Cloud-Based solutions make them ideal for businesses that experience fluctuating demand or rapid growth. However, some organizations may have concerns about data security and privacy when using Cloud-Based solutions, as sensitive data is stored off-site. Despite these concerns, the trend towards cloud adoption is strong, driven by the need for businesses to remain agile and responsive in a dynamic market environment. Both On-Premises and Cloud-Based APM solutions have their own set of advantages and challenges, and the choice between the two often depends on the specific needs and resources of the business. As the APM market continues to evolve, businesses are increasingly looking for hybrid solutions that combine the best of both worlds, offering the control and security of On-Premises solutions with the flexibility and scalability of Cloud-Based solutions.

Large Enterprises, SMEs in the Global Application Performance Monitoring Software Market:

The usage of Global Application Performance Monitoring Software Market varies significantly between large enterprises and small to medium-sized enterprises (SMEs), reflecting their distinct operational needs and resource capabilities. Large enterprises typically have complex IT environments with numerous applications and systems that require constant monitoring to ensure optimal performance. For these organizations, APM software is essential for maintaining high levels of service availability and performance, which are critical for customer satisfaction and business continuity. Large enterprises often opt for On-Premises APM solutions due to their need for greater control over data and system integration. These solutions allow them to customize the monitoring tools to fit their specific requirements and integrate seamlessly with existing IT infrastructure. Additionally, large enterprises have the resources to manage and maintain On-Premises solutions, making them a viable option despite the higher costs associated with implementation and maintenance. On the other hand, SMEs often face different challenges when it comes to application performance monitoring. With limited resources and IT budgets, SMEs require cost-effective solutions that are easy to deploy and manage. Cloud-Based APM solutions are particularly appealing to SMEs as they offer lower upfront costs, scalability, and ease of use. These solutions enable SMEs to quickly implement APM tools without the need for significant capital investment in IT infrastructure. Furthermore, Cloud-Based solutions provide SMEs with access to advanced monitoring capabilities and analytics that were previously only available to larger organizations. This democratization of technology allows SMEs to compete more effectively in the market by ensuring their applications perform optimally and deliver a positive user experience. Despite the differences in usage between large enterprises and SMEs, both types of organizations recognize the importance of APM software in maintaining application performance and ensuring business success. As the digital landscape continues to evolve, the demand for APM solutions is expected to grow across all business sizes, driven by the need for businesses to deliver high-quality digital experiences to their customers.

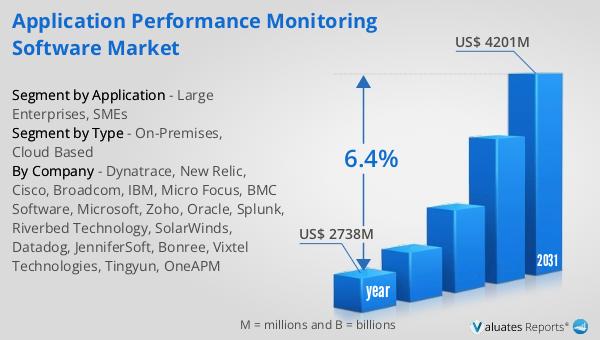

Global Application Performance Monitoring Software Market Outlook:

The global market for Application Performance Monitoring Software was valued at approximately $2,738 million in 2024 and is anticipated to expand to a revised size of around $4,201 million by 2031, reflecting a compound annual growth rate (CAGR) of 6.4% over the forecast period. This growth trajectory underscores the increasing importance of APM solutions in today's digital economy, where businesses are under constant pressure to ensure their applications perform optimally. Within this market, the On-Premises segment holds a dominant share, accounting for 70% of the market. This significant share highlights the preference of many organizations, particularly large enterprises, for On-Premises solutions due to their need for greater control over data and system integration. Despite the growing trend towards cloud adoption, the demand for On-Premises solutions remains strong, driven by organizations with stringent security and compliance requirements. As the APM market continues to evolve, businesses are increasingly seeking solutions that offer a balance between control, security, and flexibility, leading to the development of hybrid models that combine the best of both On-Premises and Cloud-Based solutions. This dynamic market environment presents significant opportunities for vendors to innovate and deliver solutions that meet the diverse needs of businesses across different industries and geographies.

| Report Metric | Details |

| Report Name | Application Performance Monitoring Software Market |

| Accounted market size in year | US$ 2738 million |

| Forecasted market size in 2031 | US$ 4201 million |

| CAGR | 6.4% |

| Base Year | year |

| Forecasted years | 2025 - 2031 |

| Segment by Type |

|

| Segment by Application |

|

| By Region |

|

| By Company | Dynatrace, New Relic, Cisco, Broadcom, IBM, Micro Focus, BMC Software, Microsoft, Zoho, Oracle, Splunk, Riverbed Technology, SolarWinds, Datadog, JenniferSoft, Bonree, Vixtel Technologies, Tingyun, OneAPM |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |