What is Global Pellicles for EUV Reticles Market?

The Global Pellicles for EUV Reticles Market is a specialized segment within the semiconductor industry, focusing on the production and application of pellicles used in extreme ultraviolet (EUV) lithography. EUV lithography is a cutting-edge technology employed in the manufacturing of semiconductor devices, enabling the creation of smaller and more efficient microchips. Pellicles are thin, transparent membranes that protect the photomask, or reticle, from contamination during the lithography process. This protection is crucial as even the smallest particle can cause defects in the microchips, leading to significant yield losses. The market for these pellicles is driven by the increasing demand for advanced semiconductor devices, which require precise and efficient manufacturing processes. As the semiconductor industry continues to evolve, the need for high-quality pellicles that can withstand the rigorous conditions of EUV lithography becomes more pronounced. Companies within this market are focused on developing pellicles with high transmission rates and durability to meet the stringent requirements of modern semiconductor manufacturing. The growth of this market is indicative of the broader trends in the semiconductor industry, where innovation and precision are paramount.

≥90% Transmission Rate, <90% Transmission Rate in the Global Pellicles for EUV Reticles Market:

In the Global Pellicles for EUV Reticles Market, transmission rates are a critical factor that determines the efficiency and effectiveness of pellicles used in EUV lithography. Transmission rate refers to the percentage of EUV light that passes through the pellicle to reach the reticle. A higher transmission rate is generally preferred as it allows more light to reach the reticle, improving the lithography process's overall efficiency. Pellicles with a transmission rate of ≥90% are considered high-performance and are sought after for their ability to maximize light throughput while minimizing energy loss. These pellicles are typically used in advanced semiconductor manufacturing processes where precision and efficiency are paramount. On the other hand, pellicles with a transmission rate of <90% are still valuable but may be used in less demanding applications or where cost considerations are more critical. The development of pellicles with varying transmission rates allows manufacturers to tailor their products to specific needs, balancing performance and cost. The choice between ≥90% and <90% transmission rate pellicles depends on several factors, including the specific requirements of the semiconductor manufacturing process, the desired level of precision, and budget constraints. As the semiconductor industry continues to advance, the demand for high-performance pellicles with ≥90% transmission rates is expected to grow, driven by the need for more efficient and precise manufacturing processes. However, pellicles with <90% transmission rates will still play a role in the market, providing a cost-effective solution for less demanding applications. The ongoing development and innovation in pellicle technology are crucial for meeting the evolving needs of the semiconductor industry, ensuring that manufacturers can produce high-quality microchips with minimal defects. As such, the Global Pellicles for EUV Reticles Market is characterized by a dynamic interplay between performance, cost, and technological advancement, with transmission rates serving as a key differentiator in product offerings.

IDM, Foundry in the Global Pellicles for EUV Reticles Market:

The usage of Global Pellicles for EUV Reticles Market in Integrated Device Manufacturers (IDM) and Foundries is pivotal to the semiconductor industry's advancement. IDMs are companies that design, manufacture, and sell integrated circuits (ICs) in-house. They require high-performance pellicles to ensure the precision and efficiency of their semiconductor manufacturing processes. In IDMs, pellicles are used to protect the reticles during EUV lithography, preventing contamination and ensuring the production of defect-free microchips. The demand for pellicles in IDMs is driven by the need for advanced semiconductor devices that require precise and efficient manufacturing processes. As IDMs continue to push the boundaries of semiconductor technology, the need for high-quality pellicles that can withstand the rigorous conditions of EUV lithography becomes increasingly important. Foundries, on the other hand, are companies that manufacture ICs for other companies, often referred to as fabless companies. Foundries play a crucial role in the semiconductor supply chain, providing manufacturing services to a wide range of customers. In foundries, pellicles are used to ensure the quality and reliability of the semiconductor manufacturing process, protecting the reticles from contamination and ensuring the production of high-quality microchips. The demand for pellicles in foundries is driven by the need to meet the diverse requirements of their customers, who demand high-quality and reliable semiconductor devices. The usage of pellicles in both IDMs and foundries highlights the critical role they play in the semiconductor industry, ensuring the production of high-quality and reliable microchips. As the semiconductor industry continues to evolve, the demand for advanced pellicles that can meet the stringent requirements of modern manufacturing processes is expected to grow, driving innovation and development in the Global Pellicles for EUV Reticles Market.

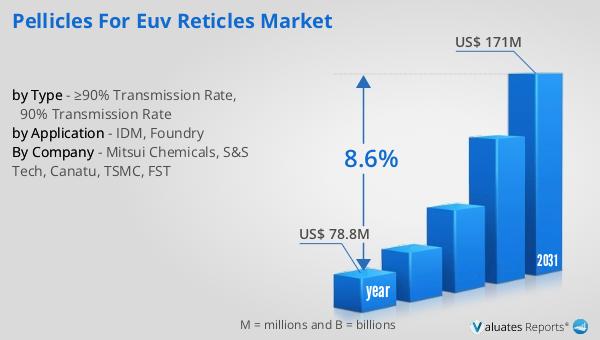

Global Pellicles for EUV Reticles Market Outlook:

The global market for Pellicles for EUV Reticles was valued at approximately $78.8 million in 2024, with projections indicating a significant growth trajectory, reaching an estimated $171 million by 2031. This growth is expected to occur at a compound annual growth rate (CAGR) of 8.6% over the forecast period. A notable development in this market was the introduction of a pellicle with a transmittance exceeding 90% by the South Korean company SS Tech in 2021. This innovation underscores the industry's focus on enhancing pellicle performance to meet the increasing demands of advanced semiconductor manufacturing. The high transmittance rate is crucial for maximizing light throughput during the EUV lithography process, thereby improving the efficiency and precision of semiconductor production. As the market continues to expand, driven by the growing demand for advanced semiconductor devices, innovations such as those introduced by SS Tech are expected to play a pivotal role in shaping the future of the Global Pellicles for EUV Reticles Market. The emphasis on high-performance pellicles with superior transmission rates reflects the industry's commitment to advancing semiconductor technology and meeting the evolving needs of manufacturers worldwide.

| Report Metric | Details |

| Report Name | Pellicles for EUV Reticles Market |

| Accounted market size in year | US$ 78.8 million |

| Forecasted market size in 2031 | US$ 171 million |

| CAGR | 8.6% |

| Base Year | year |

| Forecasted years | 2025 - 2031 |

| by Type |

|

| by Application |

|

| Production by Region |

|

| Consumption by Region |

|

| By Company | Mitsui Chemicals, S&S Tech, Canatu, TSMC, FST |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |