What is Global Fintech Technologies Market?

The Global Fintech Technologies Market is a vast and dynamic sector that is revolutionizing the way we handle money and conduct financial transactions. Fintech, a portmanteau of 'financial technology', refers to the use of technology to deliver financial services. This market encompasses a wide range of applications, from mobile banking and payment apps to cryptocurrency and robo-advising. The global fintech market is not confined to one region or country; it spans across the globe, with companies in North America, Europe, Asia, and other regions contributing to its growth. The market is driven by factors such as the increasing use of technology in financial services, the rise of e-commerce, and the growing demand for convenient and easy-to-use financial solutions. The market is also being shaped by emerging trends such as artificial intelligence, blockchain technology, and the rise of neobanks.

Mobile Based, Web Based in the Global Fintech Technologies Market:

The Global Fintech Technologies Market is divided into two main segments: mobile-based and web-based. Mobile-based fintech refers to financial services that are delivered through mobile devices, such as smartphones and tablets. This includes mobile banking, mobile payment apps, and mobile trading platforms. On the other hand, web-based fintech refers to financial services that are delivered through the internet, typically via a website. This includes online banking, online trading platforms, and online lending platforms. Both segments have their own unique advantages. Mobile-based fintech offers convenience and accessibility, allowing users to access financial services anytime, anywhere. Web-based fintech, on the other hand, offers a wider range of services and is often more suited for complex financial tasks.

Security Solutions, Payment Solutions, Wealth Management, Insurance, Others in the Global Fintech Technologies Market:

The Global Fintech Technologies Market is used in a variety of areas, including security solutions, payment solutions, wealth management, insurance, and others. In the area of security solutions, fintech technologies are used to enhance the security of financial transactions and protect against fraud. This includes technologies such as biometric authentication, encryption, and blockchain. In the area of payment solutions, fintech technologies are used to facilitate fast and convenient payments. This includes mobile payment apps, digital wallets, and contactless payment technologies. In the area of wealth management, fintech technologies are used to provide personalized financial advice and investment management services. This includes robo-advisors and AI-powered financial planning tools. In the area of insurance, fintech technologies are used to streamline the insurance process and provide customized insurance products. This includes insurtech platforms and AI-powered insurance underwriting tools.

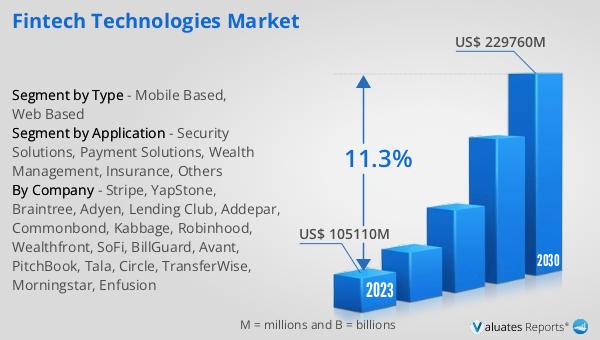

Global Fintech Technologies Market Outlook:

Looking at the market outlook, the Global Fintech Technologies Market has shown impressive growth in recent years. In 2023, the market was valued at a substantial US$ 105110 million. The market is expected to continue its upward trajectory, with projections indicating a value of US$ 229760 million by 2030. This represents a compound annual growth rate (CAGR) of 11.3% during the forecast period from 2024 to 2030. This growth can be attributed to several factors, including the increasing adoption of digital payments, the rise of mobile banking, and the growing demand for personalized financial services. The market's growth is also being fueled by technological advancements and the increasing use of AI and machine learning in financial services.

| Report Metric | Details |

| Report Name | Fintech Technologies Market |

| Accounted market size in 2023 | US$ 105110 million |

| Forecasted market size in 2030 | US$ 229760 million |

| CAGR | 11.3% |

| Base Year | 2023 |

| Forecasted years | 2024 - 2030 |

| Segment by Type |

|

| Segment by Application |

|

| By Region |

|

| By Company | Stripe, YapStone, Braintree, Adyen, Lending Club, Addepar, Commonbond, Kabbage, Robinhood, Wealthfront, SoFi, BillGuard, Avant, PitchBook, Tala, Circle, TransferWise, Morningstar, Enfusion |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |