What is Global Debt Collection Services Market?

The Global Debt Collection Services Market is a vast and complex system that involves the process of pursuing payments of debts owed by individuals or businesses. This market is a crucial part of the global economy, as it helps maintain financial stability by ensuring that debts are paid. The services offered in this market range from simple reminders to formal legal actions, depending on the severity of the debt. The market is made up of various players, including collection agencies, debt buyers, and legal networks, all working together to recover debts. The Global Debt Collection Services Market is not just about collecting debts, but also about providing solutions that help individuals and businesses manage their debts effectively. This market is driven by various factors, such as the increasing amount of debt worldwide, the growing need for efficient debt recovery solutions, and the rising use of digital platforms for debt collection. However, it also faces challenges, such as stringent regulations and the risk of bad debts. Despite these challenges, the Global Debt Collection Services Market continues to grow, offering numerous opportunities for businesses and individuals alike.

Early Out Debt, Bad Debt in the Global Debt Collection Services Market:

The Global Debt Collection Services Market is divided into two main categories: Early Out Debt and Bad Debt. Early Out Debt refers to debts that are in the early stages of delinquency, usually within the first 90 days. These debts are typically easier to collect, as the debtor is more likely to pay. On the other hand, Bad Debt refers to debts that have been delinquent for a long period, usually more than 90 days. These debts are harder to collect, as the debtor may be unable or unwilling to pay. The Global Debt Collection Services Market offers various solutions for both types of debts, including debt negotiation, debt consolidation, and debt settlement. These solutions help individuals and businesses manage their debts effectively, reducing the risk of bad debts. However, the effectiveness of these solutions depends on various factors, such as the debtor's financial situation and the nature of the debt. Despite these challenges, the Global Debt Collection Services Market continues to evolve, offering innovative solutions that cater to the changing needs of individuals and businesses.

Healthcare, Student Loans, Financial Services, Government, Retail, Telecom & Utility, Mortgage & Others in the Global Debt Collection Services Market:

The Global Debt Collection Services Market plays a crucial role in various sectors, including Healthcare, Student Loans, Financial Services, Government, Retail, Telecom & Utility, Mortgage & Others. In the Healthcare sector, this market helps hospitals and other healthcare providers recover unpaid medical bills, ensuring their financial stability. In the Student Loans sector, it helps educational institutions and lenders recover unpaid student loans, supporting the sustainability of educational funding. In the Financial Services sector, it helps banks and other financial institutions recover unpaid loans and credit card debts, maintaining their financial health. In the Government sector, it helps government agencies recover unpaid taxes and fines, supporting public funding. In the Retail sector, it helps retailers recover unpaid bills, supporting their profitability. In the Telecom & Utility sector, it helps telecom and utility companies recover unpaid bills, ensuring their operational efficiency. In the Mortgage & Others sector, it helps lenders recover unpaid mortgages, supporting the stability of the housing market. Despite the challenges, the Global Debt Collection Services Market continues to support these sectors, contributing to their financial stability and growth.

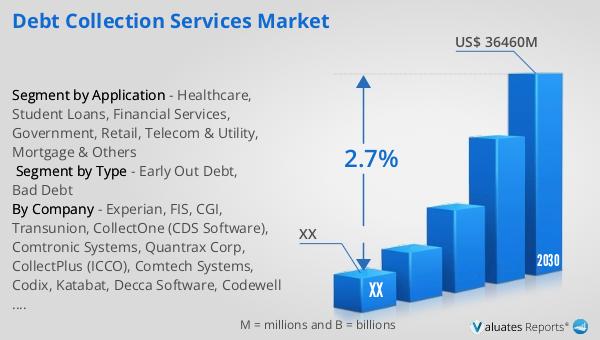

Global Debt Collection Services Market Outlook:

The Global Debt Collection Services Market is expected to grow from US$ 31070 million in 2022 to US$ 36460 million by 2029, at a Compound Annual Growth Rate (CAGR) of 2.7% during the forecast period 2023-2029. The most widely used type of service in this market is Bad Debt, which accounts for about 69% of the market. The most widely used sector is Healthcare, which accounts for about 30% of the market, followed by Financial Services, which accounts for about 20% of the market. The European market accounts for about 28% of the global market. These figures highlight the significant role of the Global Debt Collection Services Market in the global economy. Despite the challenges, this market continues to grow, driven by the increasing amount of debt worldwide and the growing need for efficient debt recovery solutions.

| Report Metric | Details |

| Report Name | Debt Collection Services Market |

| Accounted market size in 2023 | US$ 31070 million |

| Forecasted market size in 2029 | US$ 36460 million |

| CAGR | 2.7 |

| Base Year | 2023 |

| Forecasted years | 2023 - 2029 |

| Segment by Type |

|

| Segment by Application |

|

| By Region |

|

| By Company | Experian, FIS, CGI, Transunion, CollectOne (CDS Software), Comtronic Systems, Quantrax Corp, CollectPlus (ICCO), Comtech Systems, Codix, Katabat, Decca Software, Codewell Software, Adtec Software, JST CollectMax, Indigo Cloud, Pamar Systems, TrioSoft, InterProse, Cogent (AgreeYa), Kuhlekt, Lariat Software, Case Master, coeo Inkasso GmbH, Prestige Services Inc (PSI), Atradius Collections, UNIVERSUM Group, Asta Funding, Weltman, Weinberg & Reis |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |