What is Global Fuel Card Market?

The Global Fuel Card Market is a comprehensive sector that encompasses a wide range of applications and uses. Essentially, a fuel card, also known as a fleet card, is a payment card that allows the cardholder to manage and control the expenses associated with the purchase of fuel. This market is not just limited to fuel but also includes other vehicle expenses. The global reach of this market is vast, with its presence felt in various industries and sectors worldwide. The fuel card system is designed to provide a convenient, efficient, and secure way of managing and controlling fuel-related costs. It offers a streamlined and automated process, reducing the need for manual tracking and administration. The fuel card system is also equipped with features that allow for easy monitoring and reporting, making it an essential tool for businesses and organizations that operate a fleet of vehicles. The Global Fuel Card Market is a dynamic and evolving sector, with new developments and innovations continually emerging. It is a market that is driven by various factors, including the increasing need for efficient fuel management, the growing demand for cashless fuel transactions, and the rising adoption of telematics in fleet management.

Registered Fuel Card, Non-Registered Fuel Card in the Global Fuel Card Market:

The Global Fuel Card Market is segmented into two main types: Registered Fuel Card and Non-Registered Fuel Card. A Registered Fuel Card is a type of fuel card that is registered to a specific vehicle or driver. This type of card offers a higher level of security and control as it can only be used by the registered user or vehicle. It also provides detailed reporting and analysis, allowing for better management and control of fuel expenses. On the other hand, a Non-Registered Fuel Card is a type of fuel card that is not linked to a specific vehicle or driver. This type of card offers more flexibility as it can be used by anyone. However, it does not provide the same level of control and security as a Registered Fuel Card. The choice between a Registered Fuel Card and a Non-Registered Fuel Card depends on the specific needs and requirements of the user. Both types of cards offer their own set of advantages and disadvantages, and the choice between the two would depend on the specific needs and requirements of the user.

Light Weight Vehicle, Heavy Weight Vehicle in the Global Fuel Card Market:

The Global Fuel Card Market finds its application in various areas, including Light Weight Vehicles and Heavy Weight Vehicles. Light Weight Vehicles refer to vehicles that weigh less than 3.5 tons. These vehicles typically include cars, vans, and small trucks. Fuel cards for Light Weight Vehicles are designed to provide a convenient and efficient way of managing fuel expenses. They offer features such as online account management, detailed reporting, and security controls. On the other hand, Heavy Weight Vehicles refer to vehicles that weigh more than 3.5 tons. These vehicles typically include trucks, buses, and large commercial vehicles. Fuel cards for Heavy Weight Vehicles are designed to handle the higher fuel consumption and expenses associated with these vehicles. They offer features such as bulk fuel discounts, detailed reporting, and advanced security controls. The use of fuel cards in both Light Weight Vehicles and Heavy Weight Vehicles provides a streamlined and efficient way of managing fuel expenses, reducing the need for manual tracking and administration.

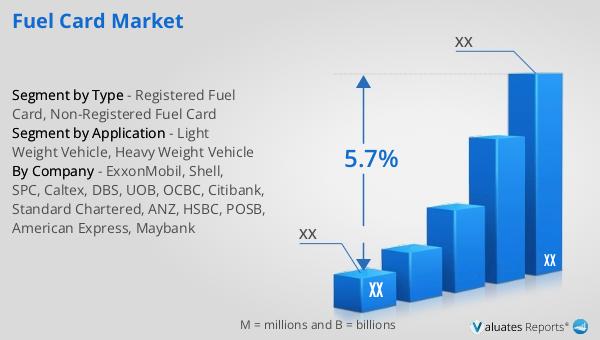

Global Fuel Card Market Outlook:

In 2022, the Global Fuel Card Market was valued at a staggering US$ 849280 million. The market is projected to reach an impressive US$ 1184410 million by 2029. This indicates a Compound Annual Growth Rate (CAGR) of 5.7% during the forecast period from 2023 to 2029. This growth can be attributed to various factors, including the increasing need for efficient fuel management, the growing demand for cashless fuel transactions, and the rising adoption of telematics in fleet management. The market is dominated by the top five manufacturers, who collectively hold a market share of about 90%. In terms of product type, Registered Fuel Card is the largest segment, accounting for about 75% of the market. This dominance of the Registered Fuel Card segment can be attributed to its higher level of security and control, as well as its ability to provide detailed reporting and analysis.

| Report Metric | Details |

| Report Name | Fuel Card Market |

| Accounted market size in 2022 | US$ 849280 in million |

| Forecasted market size in 2029 | US$ 1184410 million |

| CAGR | 5.7% |

| Base Year | 2022 |

| Forecasted years | 2023 - 2029 |

| Segment by Type |

|

| Segment by Application |

|

| By Region |

|

| By Company | ExxonMobil, Shell, SPC, Caltex, DBS, UOB, OCBC, Citibank, Standard Chartered, ANZ, HSBC, POSB, American Express, Maybank |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |