What is Global Ceria Market?

The Global Ceria Market is a vast and dynamic sector that deals with the production, distribution, and consumption of cerium oxide, also known as ceria. Ceria is a rare earth metal oxide that is widely used in various industries due to its unique properties such as high thermal stability, excellent optical properties, and strong ion conductivity. The global ceria market is a complex network of manufacturers, suppliers, distributors, and end-users spread across different regions and countries. The market dynamics are influenced by various factors such as technological advancements, economic conditions, government policies, and consumer preferences. The global ceria market is characterized by intense competition, with several large and small players vying for a larger market share. The market players are constantly striving to improve their product quality and offer innovative solutions to meet the changing needs and demands of the consumers. The global ceria market is also impacted by the fluctuations in the prices of raw materials and the cost of production. Despite these challenges, the global ceria market continues to grow and expand, driven by the increasing demand for ceria in various end-use industries such as electronics, automotive, energy, and healthcare.

Purity No More Than 2N, Purity 3N-4N, Purity No Less Than 5N in the Global Ceria Market:

The Global Ceria Market is segmented based on the purity of ceria, namely, Purity No More Than 2N, Purity 3N-4N, and Purity No Less Than 5N. Purity No More Than 2N refers to ceria with a purity level of less than 99.9%. This type of ceria is commonly used in applications where high purity is not a critical requirement. On the other hand, Purity 3N-4N refers to ceria with a purity level between 99.9% and 99.99%. This type of ceria is used in applications that require a higher level of purity, such as in the manufacturing of high-quality glass and ceramics. Lastly, Purity No Less Than 5N refers to ceria with a purity level of 99.999% or higher. This is the highest grade of ceria available in the market and is used in high-tech applications such as in the manufacturing of semiconductors and advanced optical devices. The demand for high-purity ceria is on the rise, driven by the increasing demand for high-performance materials in various industries.

Polishing, Catalysis, Glass Additives, Others in the Global Ceria Market:

The Global Ceria Market finds its usage in various areas such as Polishing, Catalysis, Glass Additives, among others. In the polishing industry, ceria is used as a polishing agent for glass, semiconductors, and other materials due to its excellent abrasive properties. In the field of catalysis, ceria is used as a catalyst or a catalyst support in various chemical reactions due to its high thermal stability and strong ion conductivity. In the glass industry, ceria is used as an additive to improve the optical properties of glass and to increase its resistance to thermal shock. Other applications of ceria include its use in the manufacturing of solid oxide fuel cells, oxygen sensors, and ultraviolet absorbers. The diverse applications of ceria in various industries are a testament to its unique properties and its potential for further growth and development.

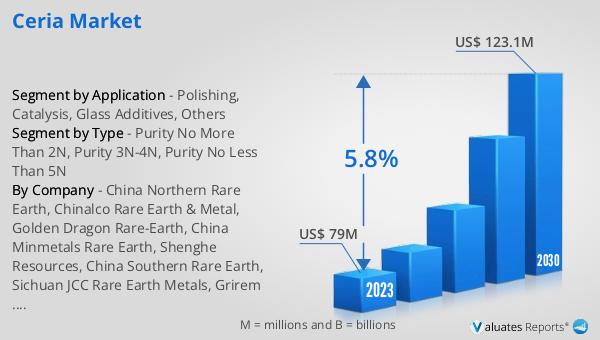

Global Ceria Market Outlook:

The global Ceria market has shown significant growth in recent years and is expected to continue this trend in the future. As of 2022, the market was valued at US$ 79 million and is projected to reach US$ 123.1 million by 2029, growing at a compound annual growth rate (CAGR) of 5.8% during the forecast period of 2023-2029. This growth can be attributed to the increasing demand for ceria in various end-use industries and the continuous efforts of market players to improve their product offerings. The market is dominated by the top 3 companies, which collectively hold a market share of about 36%. Geographically, Asia-Pacific is the largest market for ceria, accounting for about 74% of the total market share. This is followed by Europe and North America, which hold market shares of about 12% and 9% respectively. In terms of product segmentation, ceria with a purity level of no less than 5N is the largest segment, accounting for over 55% of the total market share. This indicates a high demand for high-purity ceria in various high-tech applications.

| Report Metric | Details |

| Report Name | Ceria Market |

| Accounted market size in 2022 | US$ 79 in million |

| Forecasted market size in 2029 | US$ 123.1 million |

| CAGR | 5.8% |

| Base Year | 2022 |

| Forecasted years | 2023 - 2029 |

| Segment by Type |

|

| Segment by Application |

|

| Production by Region |

|

| Consumption by Region |

|

| By Company | China Northern Rare Earth, Chinalco Rare Earth & Metal, Golden Dragon Rare-Earth, China Minmetals Rare Earth, Shenghe Resources, China Southern Rare Earth, Sichuan JCC Rare Earth Metals, Grirem Advanced Materials, Lynas Rare Earths, Neo Performance Materials |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |