What is Global Commercial Vehicle Forged Aluminum Alloy Wheels Market?

The Global Commercial Vehicle Forged Aluminum Alloy Wheels Market is a specialized segment within the automotive industry that focuses on the production and distribution of wheels made from forged aluminum alloy for commercial vehicles. These wheels are known for their strength, durability, and lightweight properties, making them an ideal choice for commercial vehicles that require robust performance and efficiency. Forged aluminum alloy wheels are manufactured through a process that involves shaping the aluminum alloy under high pressure, resulting in a product that is stronger and more resilient than traditional cast wheels. This market caters to various types of commercial vehicles, including light, medium, and heavy-duty trucks, buses, and other transport vehicles. The demand for these wheels is driven by the need for improved fuel efficiency, enhanced vehicle performance, and reduced emissions, as lighter wheels contribute to lower overall vehicle weight. Additionally, the market is influenced by factors such as technological advancements, regulatory standards, and the growing emphasis on sustainability within the automotive industry. As a result, the Global Commercial Vehicle Forged Aluminum Alloy Wheels Market plays a crucial role in supporting the evolving needs of the commercial transportation sector.

OEM Wheels, Aftermarket Wheels in the Global Commercial Vehicle Forged Aluminum Alloy Wheels Market:

In the realm of the Global Commercial Vehicle Forged Aluminum Alloy Wheels Market, two primary categories of wheels are prevalent: OEM (Original Equipment Manufacturer) wheels and aftermarket wheels. OEM wheels are those that are supplied by the vehicle's original manufacturer and are typically included as standard equipment on new vehicles. These wheels are designed to meet the specific requirements and standards set by the vehicle manufacturer, ensuring optimal compatibility and performance. OEM wheels are often preferred by consumers who prioritize maintaining the original look and feel of their vehicles, as well as ensuring that the wheels meet the manufacturer's specifications for safety and performance. On the other hand, aftermarket wheels are those that are produced by third-party manufacturers and are available for purchase separately from the vehicle. These wheels offer consumers a wider range of options in terms of design, size, and material, allowing for greater customization and personalization of their vehicles. Aftermarket wheels can be an attractive option for those looking to enhance the aesthetic appeal of their vehicles or improve performance characteristics such as handling and fuel efficiency. In the context of the Global Commercial Vehicle Forged Aluminum Alloy Wheels Market, both OEM and aftermarket wheels play significant roles in meeting the diverse needs of consumers and businesses. OEM wheels are often associated with reliability and consistency, as they are designed to meet the stringent standards set by vehicle manufacturers. This ensures that they provide the necessary performance and safety features required for commercial vehicles, which are often subjected to demanding operating conditions. Additionally, OEM wheels are typically covered by the vehicle's warranty, providing consumers with added peace of mind. However, the aftermarket segment offers a level of flexibility and innovation that is not always available with OEM wheels. Aftermarket manufacturers often introduce new designs and technologies that can enhance the performance and appearance of commercial vehicles. This includes the use of advanced materials and manufacturing techniques that can result in lighter, stronger, and more efficient wheels. Furthermore, the aftermarket segment allows consumers to choose from a wide variety of styles and finishes, enabling them to tailor their vehicles to their specific preferences and requirements. The choice between OEM and aftermarket wheels in the Global Commercial Vehicle Forged Aluminum Alloy Wheels Market ultimately depends on the individual needs and priorities of consumers and businesses. For those who value the assurance of compatibility and adherence to manufacturer standards, OEM wheels may be the preferred option. Conversely, for those seeking greater customization and potential performance enhancements, aftermarket wheels may offer the desired flexibility and innovation. Both segments contribute to the overall growth and development of the market, as they cater to the diverse demands of the commercial vehicle industry. As the market continues to evolve, the interplay between OEM and aftermarket wheels will remain a key factor in shaping the landscape of the Global Commercial Vehicle Forged Aluminum Alloy Wheels Market.

Light Commercial Vehicle, Medium Commercial Vehicle, Heavy Duty Commercial Vehicle in the Global Commercial Vehicle Forged Aluminum Alloy Wheels Market:

The usage of Global Commercial Vehicle Forged Aluminum Alloy Wheels Market spans across various types of commercial vehicles, including light commercial vehicles (LCVs), medium commercial vehicles (MCVs), and heavy-duty commercial vehicles (HCVs). Each category of vehicle has distinct requirements and benefits from the unique properties of forged aluminum alloy wheels. Light commercial vehicles, such as small trucks and vans, benefit significantly from the lightweight nature of forged aluminum alloy wheels. These vehicles are often used for urban deliveries and short-haul transportation, where fuel efficiency and maneuverability are crucial. The reduced weight of forged aluminum wheels contributes to lower fuel consumption, which is a significant advantage for businesses looking to minimize operating costs. Additionally, the strength and durability of these wheels ensure that they can withstand the demands of frequent stops and starts, as well as the challenges of navigating urban environments. Medium commercial vehicles, which include larger trucks and buses, also gain from the advantages offered by forged aluminum alloy wheels. These vehicles typically operate over longer distances and may carry heavier loads, making durability and performance critical factors. The enhanced strength of forged aluminum wheels provides the necessary support for these vehicles, ensuring that they can handle the stresses of long-haul transportation. Moreover, the improved heat dissipation properties of aluminum alloy wheels help maintain optimal braking performance, which is essential for the safety and reliability of medium commercial vehicles. Heavy-duty commercial vehicles, such as large trucks and trailers, are perhaps the most demanding in terms of wheel performance. These vehicles are often used for transporting heavy loads over long distances, requiring wheels that can endure significant stress and strain. Forged aluminum alloy wheels are particularly well-suited for this purpose, as they offer superior strength and resistance to deformation compared to traditional steel wheels. The lightweight nature of aluminum alloy wheels also contributes to improved fuel efficiency, which is a critical consideration for operators of heavy-duty commercial vehicles. Furthermore, the corrosion resistance of aluminum alloy wheels ensures that they maintain their integrity and appearance even in harsh operating conditions. In summary, the Global Commercial Vehicle Forged Aluminum Alloy Wheels Market plays a vital role in supporting the diverse needs of light, medium, and heavy-duty commercial vehicles. The unique properties of forged aluminum alloy wheels, including their lightweight, strength, and durability, make them an ideal choice for enhancing the performance and efficiency of commercial vehicles across various applications. As the demand for more efficient and sustainable transportation solutions continues to grow, the importance of forged aluminum alloy wheels in the commercial vehicle sector is likely to increase, driving further innovation and development within the market.

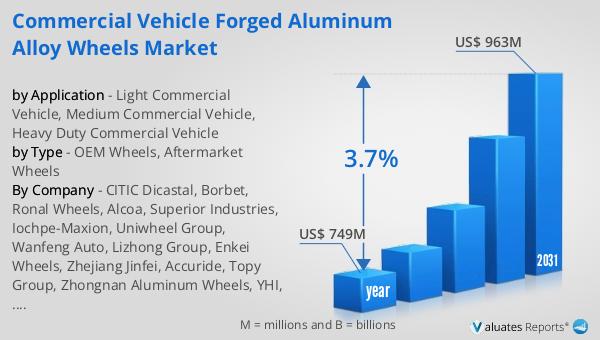

Global Commercial Vehicle Forged Aluminum Alloy Wheels Market Outlook:

The outlook for the Global Commercial Vehicle Forged Aluminum Alloy Wheels Market indicates a promising trajectory. In 2024, the market was valued at approximately $749 million, and projections suggest that it will expand to a revised size of around $963 million by 2031. This growth is expected to occur at a compound annual growth rate (CAGR) of 3.7% over the forecast period. A notable aspect of this market is the concentration of production among the top five manufacturers, who collectively hold a market share exceeding 40%. This indicates a competitive landscape where a few key players dominate the market, driving innovation and setting industry standards. The Asia-Pacific region emerges as the largest market for commercial vehicle forged aluminum alloy wheels, accounting for nearly 50% of the global market share. This dominance can be attributed to the region's robust automotive industry, increasing demand for commercial vehicles, and a growing emphasis on fuel efficiency and sustainability. The market's growth is further supported by technological advancements and the rising adoption of lightweight materials in vehicle manufacturing. As the industry continues to evolve, the Global Commercial Vehicle Forged Aluminum Alloy Wheels Market is poised to play a crucial role in shaping the future of commercial transportation, offering solutions that enhance performance, efficiency, and sustainability.

| Report Metric | Details |

| Report Name | Commercial Vehicle Forged Aluminum Alloy Wheels Market |

| Accounted market size in year | US$ 749 million |

| Forecasted market size in 2031 | US$ 963 million |

| CAGR | 3.7% |

| Base Year | year |

| Forecasted years | 2025 - 2031 |

| by Type |

|

| by Application |

|

| Production by Region |

|

| Consumption by Region |

|

| By Company | CITIC Dicastal, Borbet, Ronal Wheels, Alcoa, Superior Industries, Iochpe-Maxion, Uniwheel Group, Wanfeng Auto, Lizhong Group, Enkei Wheels, Zhejiang Jinfei, Accuride, Topy Group, Zhongnan Aluminum Wheels, YHI, Yueling Wheels, Guangdong Dcenti Auto-Parts |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |