What is Global Recreational Vehicle Insurance Market?

The Global Recreational Vehicle Insurance Market is a specialized sector of the insurance industry that caters specifically to the needs of recreational vehicle (RV) owners. This market provides insurance coverage for a variety of RV types, including motorhomes, travel trailers, fifth wheels, and more. The insurance policies offered in this market cover a range of potential risks, including damage or loss due to accidents, theft, fire, and other unforeseen circumstances. The Global Recreational Vehicle Insurance Market is a crucial component of the broader RV industry, providing necessary protection for RV owners and contributing to the overall growth and stability of the industry.

Financed RVs Insurance, Rental RVs Insurance in the Global Recreational Vehicle Insurance Market:

The Global Recreational Vehicle Insurance Market is segmented into two main categories: Financed RVs Insurance and Rental RVs Insurance. Financed RVs Insurance is designed for individuals who have financed the purchase of their RV. This type of insurance typically includes comprehensive coverage to protect against a wide range of potential risks, including damage or loss due to accidents, theft, fire, and more. Rental RVs Insurance, on the other hand, is designed for individuals who are renting an RV for a short period of time. This type of insurance typically includes liability coverage to protect against potential legal and medical costs in the event of an accident. Both types of insurance play a crucial role in the Global Recreational Vehicle Insurance Market, providing necessary protection for different types of RV users.

Motorhomes RVs, Towable RVs in the Global Recreational Vehicle Insurance Market:

The Global Recreational Vehicle Insurance Market is widely used in two main areas: Motorhomes RVs and Towable RVs. Motorhomes RVs are self-propelled vehicles that combine transportation and living quarters in one unit. These vehicles require specialized insurance coverage due to their unique combination of automotive and home risks. Towable RVs, on the other hand, are non-motorized vehicles that are towed by a motorized vehicle. These vehicles also require specialized insurance coverage due to their unique risks, including potential damage or loss while being towed. The Global Recreational Vehicle Insurance Market provides necessary insurance coverage for both types of RVs, contributing to the overall growth and stability of the RV industry.

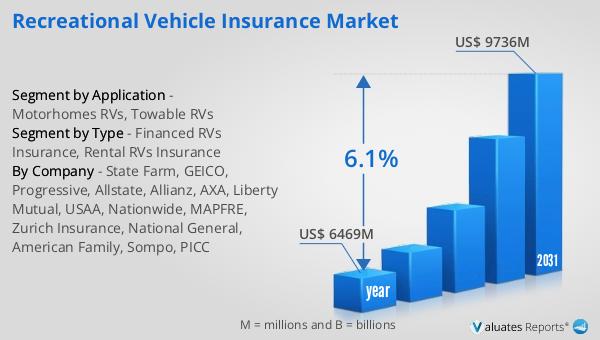

Global Recreational Vehicle Insurance Market Outlook:

The Global Recreational Vehicle Insurance Market has shown significant growth in recent years. In 2022, the market was valued at US$ 6132.7 million. It is projected to reach a value of US$ 8748.7 million by 2029, representing a compound annual growth rate (CAGR) of 6.1% during the forecast period from 2023 to 2029. The market is dominated by the top 3 players, who collectively hold over 35% of the global market shares. Rental RVs Insurance is the predominant type of insurance in this market, accounting for about 70% of the market. Motorhomes RVs represent the main application of this insurance, holding a market share of about 65%. These figures highlight the significant role of the Global Recreational Vehicle Insurance Market in the broader RV industry and its potential for continued growth in the coming years.

| Report Metric | Details |

| Report Name | Recreational Vehicle Insurance Market |

| Accounted market size in 2022 | US$ 6132.7 in million |

| Forecasted market size in 2029 | US$ 8748.7 million |

| CAGR | 6.1% |

| Base Year | 2022 |

| Forecasted years | 2023 - 2029 |

| Segment by Type |

|

| Segment by Application |

|

| By Region |

|

| By Company | State Farm, GEICO, Progressive, Allstate, Allianz, AXA, Liberty Mutual, USAA, Nationwide, MAPFRE, Zurich Insurance, National General, American Family, Sompo, PICC |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |