What is Global ATM Managed Services Market?

The Global ATM Managed Services Market is a comprehensive sector that encompasses a wide range of services related to Automated Teller Machines (ATMs). These services are designed to ensure the smooth operation of ATMs, which are crucial components of the global financial infrastructure. The market includes services such as ATM replenishment and currency management, network management, security management, incident management, and others. These services are essential for maintaining the efficiency, security, and reliability of ATMs, which are used by millions of people worldwide to carry out financial transactions. The market is driven by the increasing demand for efficient and secure financial transactions, the growing number of ATMs worldwide, and the rising need for advanced ATM management solutions. However, the market also faces challenges such as the high cost of ATM managed services and the increasing threat of cyber-attacks. Despite these challenges, the Global ATM Managed Services Market is expected to grow significantly in the coming years, driven by the increasing digitization of financial services and the growing need for efficient and secure ATM operations.

ATM Replenishment & Currency Management, Network Management, Security Management, Incident Management, Others in the Global ATM Managed Services Market:

The Global ATM Managed Services Market plays a crucial role in the operation of Bank ATMs and Retail ATMs. Bank ATMs are automated teller machines that are owned and operated by banks. They are typically located at bank branches or other locations that are convenient for bank customers. Retail ATMs, on the other hand, are owned and operated by non-bank entities and are typically located in retail stores, restaurants, and other locations where people shop or dine. Both types of ATMs require a range of managed services to ensure their efficient and secure operation. These services include ATM replenishment and currency management, which involves ensuring that ATMs are always stocked with enough cash to meet customer demand. Network management services are also crucial for maintaining the connectivity of ATMs, ensuring that they can carry out transactions quickly and efficiently. Security management services are essential for protecting ATMs from physical and cyber threats, while incident management services are needed to respond to any issues or problems that may arise with ATM operations.

Bank ATMs, Retail ATMs in the Global ATM Managed Services Market:

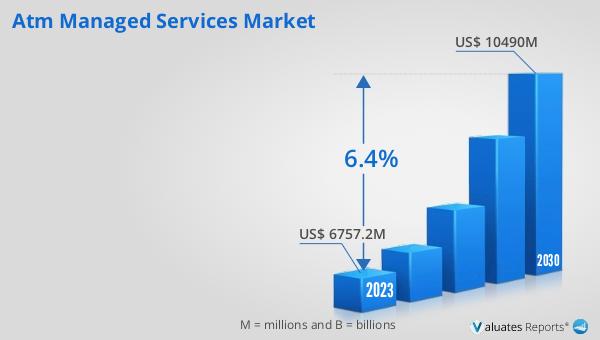

In 2022, the Global ATM Managed Services Market was valued at a substantial US$ 7226.4 million. The market is projected to grow at a steady pace, reaching an estimated value of US$ 10490 million by 2029. This represents a Compound Annual Growth Rate (CAGR) of 6.4% during the forecast period from 2023 to 2029. The Asia-Pacific region was the largest provider of ATM Managed Services in 2019, contributing 38.73% of the global output. North America and Europe followed closely, contributing 24.97% and 23.16% respectively to the global output. These figures highlight the significant role that these regions play in the Global ATM Managed Services Market, and the important contribution they make to the global financial infrastructure.

| Report Metric | Details |

| Report Name | ATM Managed Services Market |

| Accounted market size in 2022 | US$ 7226.4 in million |

| Forecasted market size in 2029 | US$ 10490 million |

| CAGR | 6.4% |

| Base Year | 2022 |

| Forecasted years | 2023 - 2029 |

| Segment by Type |

|

| Segment by Application |

|

| By Region |

|

| By Company | Diebold Nixdorf, NCR Managed Services, Euronet Worldwide, Inc., FUJITSU, Cardtronics, Fiserv, Inc., HYOSUNG, CMS Info Systems, AGS Transact Technologies Ltd., Hitachi Payment Services, Cashlink Global System, Vocalink, Electronic Payment and Services, Financial Software & Systems, QDS, Inc., Automated Transaction Delivery, CashTrans |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |