What is Global PFA Tubing Market?

The Global PFA Tubing Market is a vast and diverse sector that encompasses a wide range of applications and industries. PFA, or Perfluoroalkoxy, is a type of fluoropolymer, a high-performance plastic known for its resistance to heat, chemical reactions, and electrical conductivity. This makes PFA tubing an ideal choice for industries that require durable, reliable, and high-performance materials. PFA tubing comes in various forms, each with its unique characteristics and applications. PFA Standard Tubing (Straight) is the most common type, known for its straight, rigid structure. This type of tubing is often used in industries that require precise, unchanging shapes, such as the automotive or aerospace industries. PFA Standard Tubing (Corrugated) is another type, known for its flexible, corrugated structure. This type of tubing is often used in industries that require flexibility, such as the medical or food processing industries. PFA HP (High Purity) Tubing is a specialized type of tubing known for its high purity levels. This type of tubing is often used in industries that require high levels of cleanliness and purity, such as the pharmaceutical or semiconductor manufacturing industries. Lastly, there are other types of PFA tubing that cater to specific needs and applications.

PFA Standard Tubing (Straight), PFA Standard Tubing (Corrugated), PFA HP (High Purity) Tubing, Other in the Global PFA Tubing Market:

The Global PFA Tubing Market is not limited to one industry or application. It spans across various sectors, each with its unique needs and requirements. The pharmaceutical industry, for instance, uses PFA tubing in various applications, such as drug delivery systems and medical devices. The chemical industry also uses PFA tubing, particularly in chemical processing and handling applications. The electronic and electrical industry uses PFA tubing in various applications, such as wiring and cable insulation. The semiconductor manufacturing equipment industry uses PFA tubing, particularly in chip manufacturing and processing applications. The automotive industry uses PFA tubing in various applications, such as fuel lines and brake systems. The food processing industry uses PFA tubing, particularly in food and beverage processing and handling applications. Lastly, there are other industries that use PFA tubing, each with its unique applications and requirements.

Pharmaceutical Industry, Chemical Industry, Electronic and Electrical, Semiconductor Manufacturing Equipment, Automotive Industry, Food Processing, Other in the Global PFA Tubing Market:

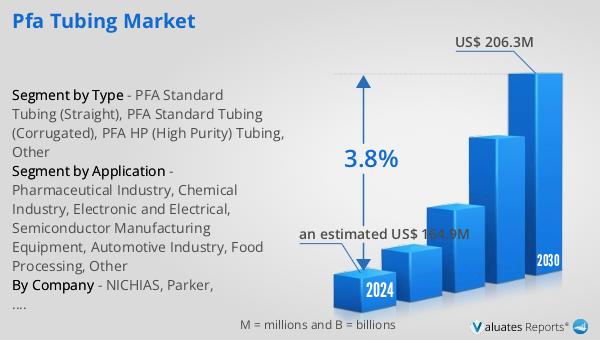

The Global PFA Tubing Market is a dynamic and evolving sector. In 2022, the market was valued at US$ 155.6 million. It is projected to reach US$ 206.3 million by 2029, growing at a compound annual growth rate (CAGR) of 3.8% from 2023 to 2029. This growth is driven by various factors, such as the increasing demand for high-performance materials in various industries, the growing adoption of PFA tubing in emerging markets, and the continuous advancements in PFA tubing technology. The market is also characterized by a high level of competition, with the top 5 manufacturers accounting for over 40% of the market share. In terms of product types, PFA HP (high purity) tubing is the largest segment, accounting for about 55% of the market share. This dominance is due to the high demand for high-purity materials in various industries, such as the pharmaceutical and semiconductor manufacturing industries.

Global PFA Tubing Market Outlook:

In conclusion, the Global PFA Tubing Market is a vast and diverse sector that offers a wide range of opportunities for growth and innovation. With its wide range of applications and industries, the market is poised for continuous growth and evolution in the coming years.

| Report Metric | Details |

| Report Name | PFA Tubing Market |

| Accounted market size in 2023 | US$ 164.9 million |

| Forecasted market size in 2029 | US$ 206.3 million |

| CAGR | 3.8 |

| Base Year | 2023 |

| Forecasted years | 2023 - 2029 |

| Segment by Type |

|

| Segment by Application |

|

| Production by Region |

|

| Sales by Region |

|

| By Company | NICHIAS, Parker, Swagelok, Nippon Pillar, Yodogawa, Zeus, Altaflo, Tef-Cap Industries, Junkosha, Polyflon Technology Limited, Entegris, Fluorotherm, Habia Teknofluor, AS Strömungstechnik, PAR Group, NES IPS (Integrated Polymer Solutions), Xtraflex, NewAge Industries, Saint-Gobain, EnPro Industries (Rubber Fab of Garlock Hygienic), AMETEK, Adtech Polymer Engineering, Grayline, Holscot, Bueno Technology, IDEX (IDEX Health&Science) |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |