What is Global Counterparty Due Diligence Services Market?

The Global Counterparty Due Diligence Services Market is a complex and dynamic field that plays a crucial role in the world of business and finance. It refers to the process of thoroughly investigating and verifying the details of a potential business partner or investment opportunity before entering into a financial agreement or transaction. This process is designed to identify any potential risks or liabilities, ensuring that all parties involved are fully aware of the details and implications of the transaction. The goal of due diligence is to prevent any unpleasant surprises down the line, and to ensure that the transaction is fair, transparent, and beneficial for all parties involved. The global market for these services is vast and varied, encompassing a wide range of industries and sectors.

Financial Due Diligence, Legal Due Diligence, Tax Due Diligence, Operational Due Diligence, Others in the Global Counterparty Due Diligence Services Market:

Financial Due Diligence, Legal Due Diligence, Tax Due Diligence, Operational Due Diligence, and others are all critical components of the Global Counterparty Due Diligence Services Market. Financial Due Diligence involves a thorough examination of a company's financial records, including its assets, liabilities, income, and expenses. This process is designed to verify the financial health and stability of the company, and to identify any potential financial risks or liabilities. Legal Due Diligence, on the other hand, involves a comprehensive review of a company's legal affairs, including its contracts, legal disputes, and compliance with laws and regulations. This process is designed to identify any potential legal risks or liabilities, and to ensure that the company is operating within the bounds of the law. Tax Due Diligence involves a detailed examination of a company's tax records, including its tax returns, tax payments, and tax liabilities. This process is designed to verify the company's compliance with tax laws and regulations, and to identify any potential tax risks or liabilities. Operational Due Diligence involves a thorough review of a company's operations, including its processes, systems, and performance. This process is designed to assess the efficiency and effectiveness of the company's operations, and to identify any potential operational risks or liabilities. Other types of due diligence may include environmental due diligence, IT due diligence, and human resources due diligence, among others. Each of these processes plays a vital role in the due diligence process, providing a comprehensive and holistic view of the company and its operations.

Energy, Oil and Gas, Pharmaceutical, Others in the Global Counterparty Due Diligence Services Market:

The Global Counterparty Due Diligence Services Market is widely used in a variety of sectors, including Energy, Oil and Gas, Pharmaceutical, and others. In the Energy sector, due diligence services are used to assess the viability and profitability of potential energy projects, as well as to identify any potential risks or liabilities. This can include examining the project's financial records, legal affairs, tax records, and operational processes, among other things. In the Oil and Gas sector, due diligence services are used to evaluate potential oil and gas investments, as well as to identify any potential risks or liabilities. This can involve a thorough examination of the investment's financial records, legal affairs, tax records, and operational processes, among other things. In the Pharmaceutical sector, due diligence services are used to assess potential pharmaceutical investments, as well as to identify any potential risks or liabilities. This can include a detailed review of the investment's financial records, legal affairs, tax records, and operational processes, among other things. Other sectors that make use of due diligence services include the technology sector, the manufacturing sector, the real estate sector, and the financial services sector, among others. Each of these sectors has its own unique needs and requirements when it comes to due diligence, and the Global Counterparty Due Diligence Services Market is well-equipped to meet these needs.

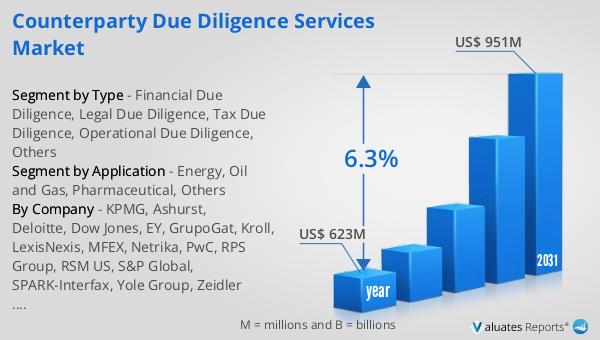

Global Counterparty Due Diligence Services Market Outlook:

The Global Counterparty Due Diligence Services Market has shown significant growth in recent years. In 2022, the market was valued at US$ 590 million. This figure is expected to increase substantially over the next few years, reaching an estimated value of US$ 851.2 million by 2029. This represents a Compound Annual Growth Rate (CAGR) of 6.3% during the forecast period from 2023 to 2029. This growth can be attributed to a number of factors, including the increasing complexity of business transactions, the growing need for transparency and accountability in business dealings, and the rising demand for due diligence services in a variety of sectors. As businesses continue to expand and diversify, the need for thorough and comprehensive due diligence services is likely to increase. This, in turn, is expected to drive further growth in the Global Counterparty Due Diligence Services Market.

| Report Metric | Details |

| Report Name | Counterparty Due Diligence Services Market |

| Accounted market size in 2022 | US$ 590 in million |

| Forecasted market size in 2029 | US$ 851.2 million |

| CAGR | 6.3% |

| Base Year | 2022 |

| Forecasted years | 2023 - 2029 |

| Segment by Type |

|

| Segment by Application |

|

| By Region |

|

| By Company | KPMG, Ashurst, Deloitte, Dow Jones, EY, GrupoGat, Kroll, LexisNexis, MFEX, Netrika, PwC, RPS Group, RSM US, S&P Global, SPARK-Interfax, Yole Group, Zeidler Group |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |