What is Global Commercial Auto Insurance Market?

The Global Commercial Auto Insurance Market is a vast and dynamic sector that provides coverage for all types of commercial vehicles. This market is not limited to just trucks and vans used for business purposes, but also includes other vehicles like taxis, buses, agricultural vehicles, and construction vehicles. The insurance policies offered in this market cover a wide range of risks, including vehicle damage, theft, and liability for bodily injury or property damage. The global commercial auto insurance market is a crucial component of the overall insurance industry, providing essential protection for businesses and their assets. It helps businesses manage the financial risks associated with vehicle accidents, theft, and other unforeseen incidents. The market is influenced by various factors such as the number of commercial vehicles in operation, the level of economic activity, and the regulatory environment in different countries. The market is also shaped by trends in technology, such as the increasing use of telematics and data analytics for risk assessment and pricing.

Liability Insurance, Physical Damage Insurance, Others in the Global Commercial Auto Insurance Market Market:

Liability Insurance, Physical Damage Insurance, and Others are the three main types of coverage offered in the Global Commercial Auto Insurance Market. Liability Insurance is a mandatory requirement in many countries and provides coverage for damages caused by the insured vehicle to other people or property. Physical Damage Insurance covers the cost of repairing or replacing the insured vehicle if it is damaged in an accident, stolen, or vandalized. Other types of coverage may include medical payments, uninsured motorist coverage, and coverage for goods in transit. Each type of coverage has its own pricing structure, which is determined by various factors such as the type of vehicle, the driver's driving history, and the level of coverage chosen. The choice of coverage depends on the specific needs and risk tolerance of the business. For example, a business that operates a large fleet of vehicles may opt for a comprehensive insurance policy that includes both liability and physical damage coverage, while a small business with a single vehicle may choose a more basic policy with only liability coverage.

Passenger Car, Commercial Vehicle in the Global Commercial Auto Insurance Market Market:

The Global Commercial Auto Insurance Market plays a vital role in the operation of passenger cars and commercial vehicles. For passenger cars used for business purposes, such as taxis and rental cars, commercial auto insurance provides coverage for risks such as accidents, theft, and liability for injuries to passengers. For commercial vehicles like trucks and vans, the insurance covers risks associated with the transportation of goods, including damage to the goods, liability for accidents involving other vehicles, and liability for injuries to third parties. The insurance also covers the cost of repairing or replacing the vehicle if it is damaged or stolen. The level of coverage required depends on the nature of the business and the type of vehicle used. For example, a business that uses heavy-duty trucks for transporting goods may need a higher level of coverage than a business that uses light-duty vans for local deliveries.

Global Commercial Auto Insurance Market Market Outlook:

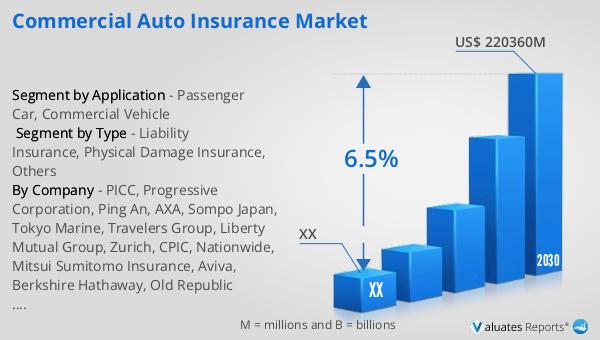

The Global Commercial Auto Insurance Market was valued at a staggering US$ 151020 million in 2022. This value is expected to surge to US$ 220360 million by 2029, marking a Compound Annual Growth Rate (CAGR) of 6.5% during the forecast period of 2023-2029. This growth can be attributed to the increasing number of commercial vehicles worldwide and the growing awareness among businesses about the importance of insurance in managing financial risks. The market is dominated by major companies like PICC, Progressive Corporation, and Ping An Insurance, which collectively accounted for over 12% of the market revenue in 2019. Europe emerged as the leading region in terms of revenue, contributing to over one-third of the global market income. This dominance can be attributed to the high number of commercial vehicles in operation in Europe and the stringent regulatory requirements for commercial auto insurance in the region.

| Report Metric | Details |

| Report Name | Commercial Auto Insurance Market |

| Accounted market size in 2022 | US$ 151020 in million |

| Forecasted market size in 2029 | US$ 220360 million |

| CAGR | 6.5% |

| Base Year | 2022 |

| Forecasted years | 2023 - 2029 |

| Segment by Type |

|

| Segment by Application |

|

| By Region |

|

| By Company | PICC, Progressive Corporation, Ping An, AXA, Sompo Japan, Tokyo Marine, Travelers Group, Liberty Mutual Group, Zurich, CPIC, Nationwide, Mitsui Sumitomo Insurance, Aviva, Berkshire Hathaway, Old Republic International, Auto Owners Grp., Generali Group, MAPFRE, Chubb, AmTrust NGH |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |