What is Global Purified Terephthalic Acid for Textile (PTA) Market?

Global Purified Terephthalic Acid (PTA) for the textile market is a significant segment within the chemical industry, primarily driven by the demand for polyester fibers. PTA is a crucial raw material used in the production of polyester, which is widely utilized in the textile industry for manufacturing various types of fabrics and garments. The global PTA market is characterized by its extensive use in producing polyester fibers, which are favored for their durability, wrinkle resistance, and ease of maintenance. The textile industry relies heavily on PTA due to its role in enhancing the quality and performance of polyester products. As the demand for polyester textiles continues to grow, driven by factors such as population growth, urbanization, and changing fashion trends, the PTA market is expected to expand. Additionally, the market is influenced by technological advancements in production processes, which aim to improve efficiency and reduce environmental impact. The global PTA market is also shaped by regional dynamics, with Asia-Pacific being a major hub for production and consumption due to its large textile manufacturing base. Overall, the Global Purified Terephthalic Acid for Textile market plays a vital role in meeting the demands of the textile industry, contributing to the production of high-quality polyester products.

Petroleum-based PTA, Bio-based PTA, Others in the Global Purified Terephthalic Acid for Textile (PTA) Market:

Petroleum-based PTA is the most traditional and widely used form of Purified Terephthalic Acid in the textile industry. Derived from petrochemical sources, this type of PTA is produced through the oxidation of paraxylene, a process that involves several chemical reactions to achieve the desired purity and quality. Petroleum-based PTA is favored for its cost-effectiveness and established production infrastructure, making it a dominant choice for manufacturers. However, the reliance on fossil fuels and the environmental concerns associated with petrochemical processes have led to increased scrutiny and calls for more sustainable alternatives. In response to these concerns, the industry has been exploring bio-based PTA as a more environmentally friendly option. Bio-based PTA is derived from renewable resources, such as plant-based materials, and aims to reduce the carbon footprint associated with traditional PTA production. The development of bio-based PTA is still in its nascent stages, with ongoing research and innovation focused on improving production efficiency and scalability. Despite the challenges, bio-based PTA holds promise as a sustainable alternative that aligns with the growing demand for eco-friendly products in the textile industry. In addition to petroleum-based and bio-based PTA, there are other emerging alternatives being explored in the market. These include recycled PTA, which involves the recovery and reuse of PTA from post-consumer and post-industrial waste. Recycled PTA offers a circular approach to production, reducing the reliance on virgin raw materials and minimizing waste. The adoption of recycled PTA is gaining traction as part of broader sustainability initiatives within the textile industry. Furthermore, advancements in technology and research are paving the way for innovative PTA production methods that aim to enhance efficiency and reduce environmental impact. These developments reflect the industry's commitment to addressing environmental challenges and meeting the evolving demands of consumers for more sustainable textile products. Overall, the Global Purified Terephthalic Acid for Textile market is witnessing a shift towards more sustainable and environmentally conscious practices, driven by the need to balance economic viability with environmental responsibility.

Polyester Filament, Polyester Staple Fiber, Others in the Global Purified Terephthalic Acid for Textile (PTA) Market:

The usage of Global Purified Terephthalic Acid for Textile (PTA) Market is predominantly seen in the production of polyester filament, polyester staple fiber, and other textile applications. Polyester filament is a continuous fiber that is widely used in the textile industry for producing fabrics with a smooth and lustrous finish. PTA plays a crucial role in the production of polyester filament by providing the necessary chemical structure and properties that enhance the strength, durability, and aesthetic appeal of the final product. Polyester filament is favored for its versatility and is used in a variety of applications, including apparel, home textiles, and industrial fabrics. The demand for polyester filament is driven by its ability to mimic the appearance and feel of natural fibers while offering superior performance characteristics. In addition to polyester filament, PTA is also extensively used in the production of polyester staple fiber. Polyester staple fiber is a short-length fiber that is spun into yarn and used in the manufacturing of textiles such as clothing, upholstery, and non-woven fabrics. PTA contributes to the production of polyester staple fiber by providing the necessary chemical composition that enhances the fiber's strength, resilience, and dyeability. The demand for polyester staple fiber is driven by its affordability, versatility, and ability to blend with other fibers to create a wide range of textile products. Beyond polyester filament and staple fiber, PTA is also used in other textile applications, including the production of polyester films, resins, and coatings. These applications leverage the unique properties of PTA to enhance the performance and functionality of the final products. Polyester films, for example, are used in packaging, electrical insulation, and photographic applications due to their clarity, strength, and barrier properties. Similarly, polyester resins and coatings are used in various industrial applications to provide protective and decorative finishes. The versatility and wide range of applications of PTA in the textile industry underscore its importance as a key raw material that drives innovation and growth in the sector. As the demand for polyester textiles continues to rise, driven by factors such as population growth, urbanization, and changing consumer preferences, the Global Purified Terephthalic Acid for Textile market is expected to play a pivotal role in meeting the evolving needs of the industry.

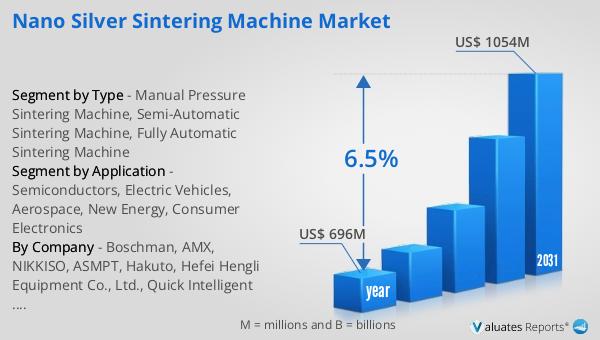

Global Purified Terephthalic Acid for Textile (PTA) Market Outlook:

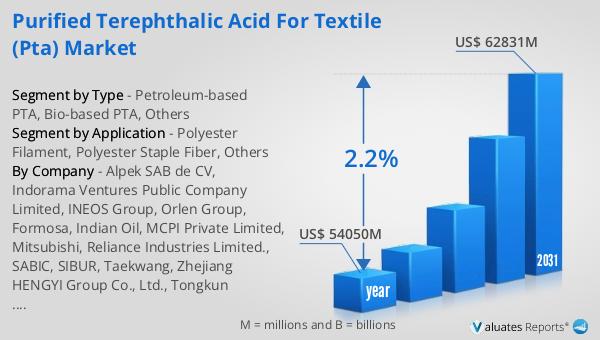

The global market for Purified Terephthalic Acid (PTA) for textiles was valued at approximately $54,050 million in 2024. This market is anticipated to grow steadily, reaching an estimated size of $62,831 million by 2031. This growth trajectory represents a compound annual growth rate (CAGR) of 2.2% over the forecast period. The steady increase in market size reflects the ongoing demand for PTA in the textile industry, driven by the widespread use of polyester fibers in various applications. Polyester, being a versatile and durable material, continues to be a preferred choice in the textile sector, contributing to the sustained demand for PTA. The market's growth is also influenced by factors such as technological advancements in production processes, which aim to enhance efficiency and reduce environmental impact. Additionally, the increasing focus on sustainability and the development of bio-based and recycled PTA alternatives are expected to shape the market dynamics in the coming years. As the textile industry continues to evolve and adapt to changing consumer preferences and environmental considerations, the Global Purified Terephthalic Acid for Textile market is poised to play a crucial role in supporting the production of high-quality and sustainable polyester products.

| Report Metric | Details |

| Report Name | Purified Terephthalic Acid for Textile (PTA) Market |

| Accounted market size in year | US$ 54050 million |

| Forecasted market size in 2031 | US$ 62831 million |

| CAGR | 2.2% |

| Base Year | year |

| Forecasted years | 2025 - 2031 |

| Segment by Type |

|

| Segment by Application |

|

| Production by Region |

|

| Consumption by Region |

|

| By Company | Alpek SAB de CV, Indorama Ventures Public Company Limited, INEOS Group, Orlen Group, Formosa, Indian Oil, MCPI Private Limited, Mitsubishi, Reliance Industries Limited., SABIC, SIBUR, Taekwang, Zhejiang HENGYI Group Co., Ltd., Tongkun Holdings Group Co., Ltd., Xinfengming Group Co., Ltd., Shenghong Petrochemical Group Co., Ltd., Sanfame Group Co., Ltd., China Petroleum & Chemical Corporation |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |